How to Finance a Tow Truck? Discover 3 Personal Loan Solutions

Starting or expanding a towing business often requires significant investment, and understanding how to finance a tow truck is crucial for success. With tow trucks being the most critical and costly component of the business, their prices can range from tens to hundreds of thousands of dollars based on their type, size, and model. Since purchasing a tow truck outright is often not feasible, exploring various financing options becomes an essential step for many entrepreneurs.

In this article, we’ll explore the various ways you can finance a tow truck, covering everything from traditional loans to alternative funding options. Understanding these methods will help you make informed choices for your towing business’s growth and sustainability.

Table of Contents

- Understanding Your Tow Truck Financing Options

- Bank Loans for Tow Truck Financing

- Tow Truck Financing through Specialized Lenders

- How to Lease a Tow Truck Instead of Buying

- Personal Loans for Tow Truck Financing

- Alternative Financing Options for Tow Truck Businesses

- How to Qualify for Tow Truck Financing: Key Requirements

- Tips for Managing Tow Truck Financing and Loan Repayment

- How Profitable is a Tow Truck Business?

- What’s the Best Way to Make Money with a Tow Truck?

- How to Start a Tow Truck Business with the Right Financing?

- Also Read: Do You Need a Motorcycle License to Finance a Motorcycle? 3 Powerful Factors Smart Lenders Consider

- Used Tow Trucks for Lease: Is It Worth It?

- How Much Does It Cost to Lease a Tow Truck?

- AAA Tow Truck Financing: Is It Right for You?

- Tow Trucks for Sale: Should You Buy or Lease?

- Read About: Do You Need Full Coverage on a Used Financed Car? 3 Smart Reasons to Consider It

- Tow Truck & Wrecker Financing Loan Programs: A Closer Look

- Conclusion

- Frequently Asked Questions About Finance a Tow Truck

- What credit score do I need to finance a tow truck?

- Is it better to lease or buy a tow truck?

- Can I finance a tow truck with no money down?

- Accordion title How long does it take to get approved for tow truck financing?

- Can I get a tow truck loan if my business is new?

- Are there tax benefits to financing a tow truck?

- What’s the difference between a personal loan and business loan for a tow truck?

- Can I trade in an old tow truck as part of financing a new one?

- What happens if I default on my tow truck loan?

- Do SBA loans cover tow truck financing?

Understanding Your Tow Truck Financing Options

Financing a tow truck is a crucial step for business owners in the towing industry, as a tow truck is the backbone of the operation. Fortunately, there are multiple ways to finance this essential vehicle. Each method comes with its own benefits, risks, and requirements:

- Traditional Loans: Typically involve working with banks or credit unions to secure a loan for purchasing the vehicle outright.

- Leasing: Leasing allows you to use the truck for a set period without committing to full ownership.

- Renting: Short-term renting can be helpful for temporary needs or if you want to test the market before making a full commitment.

Understanding these options allows business owners to evaluate what best fits their needs based on budget, length of use, and long-term goals.

Bank Loans for Tow Truck Financing

Bank loans are a common way to finance large purchases, including commercial vehicles like tow trucks. However, qualifying for a traditional bank loan can be challenging:

- Loan Requirements: Banks generally require a solid credit score, proof of business income, and sometimes collateral.

- Loan Terms: Bank loans often offer competitive interest rates and longer repayment terms, which can be ideal for established businesses.

- Pros and Cons: While bank loans may provide better interest rates, they can be harder to qualify for, particularly for startups or individuals with limited credit history.

This option is typically best suited for those who have been in business for a while and can meet the bank’s financial requirements.

Tow Truck Financing through Specialized Lenders

Some lenders specialize in providing financing for commercial and industrial vehicles, including tow trucks. These lenders often understand the specific needs of towing businesses better than traditional banks:

- Specialized Lender Options: Companies like Crest Capital, Balboa Capital, and Smarter Finance USA focus on vehicle financing for small businesses.

- Tailored Terms: Specialized lenders are often more flexible with credit scores and can offer customized financing plans.

- Advantages: You may get faster approval times, lower down payments, and terms that cater to seasonal fluctuations in business.

Working with a specialized lender can be a great choice if you’re looking for industry-specific guidance and flexibility in terms.

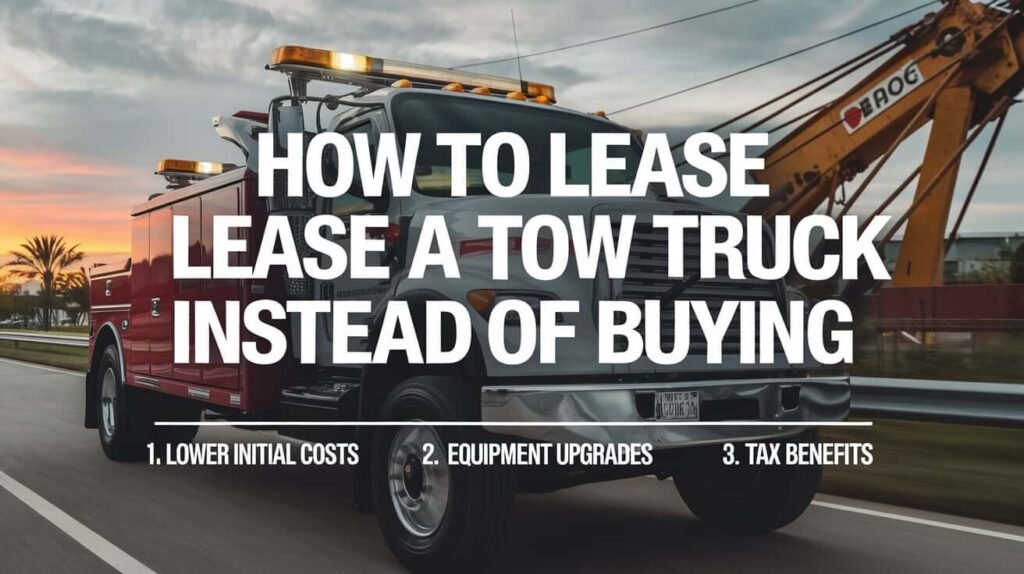

How to Lease a Tow Truck Instead of Buying

Leasing is another financing option for towing companies, offering several unique advantages over purchasing:

- Lower Initial Costs: Leasing often requires less money upfront, freeing up cash flow for other expenses.

- Equipment Upgrades: Leasing allows you to upgrade to newer trucks more frequently without being locked into long-term ownership.

- Tax Benefits: Leasing payments are often deductible as business expenses, providing potential tax advantages.

If you anticipate upgrading your tow truck frequently or want to reduce upfront costs, leasing could be an ideal solution.

Government and SBA Loans for Tow Truck Financing

Small Business Administration (SBA) loans, backed by the federal government, can be an attractive financing option:

Types of SBA Loans: The SBA 7(a) and 504 loans are commonly used for equipment purchases, offering favorable terms.

Interest Rates: SBA loans often have lower interest rates compared to conventional loans.

Extended Terms: These loans offer longer repayment terms, which can reduce monthly payments.

Although the application process can be time-consuming, SBA loans are generally worth the effort due to the competitive interest rates and extended repayment plans.

Personal Loans for Tow Truck Financing

In some cases, business owners may use personal loans for financing a tow truck, especially if they’re just starting out or have trouble qualifying for traditional business financing:

- Pros of Personal Loans: Personal loans may be easier to qualify for than business loans, particularly for those with strong personal credit.

- Risks: Using a personal loan places personal assets and credit at risk if the business struggles to make payments.

- Considerations: This approach might work for small businesses or entrepreneurs just starting in the towing industry.

Using a personal loan can bridge financing gaps but should be approached cautiously, as it intertwines personal and business finances.

Using Equipment Financing for Tow Truck Purchases

Equipment financing is a type of loan specifically designed for purchasing business equipment:

How Equipment Loans Work: The truck itself acts as collateral, which may lead to lower interest rates.

Tax Advantages: Many business owners can write off equipment financing as a tax deduction.

Flexible Terms: Terms are often set according to the lifespan of the equipment, making it easier to match repayment with income.

This financing option is ideal for business owners who want to buy a tow truck without a hefty down payment, as it typically requires minimal upfront capital.

Securing Tow Truck Financing with Bad Credit

For those with lower credit scores, obtaining financing can be more challenging but not impossible:

- Alternative Lenders: Some lenders specialize in providing loans for businesses with poor credit.

- Higher Interest Rates: Bad credit financing usually comes with higher rates, so it’s crucial to shop around for the best deal.

- Tips for Improvement: Demonstrating stable income, providing a larger down payment, and building up your business credit can improve your financing options.

It’s essential to compare different lenders and read the fine print to ensure manageable terms if you’re financing a tow truck with bad credit.

Down Payments and Trade-Ins for Tow Truck Financing

A down payment or trade-in can make a substantial difference in your loan terms:

- Down Payment Benefits: A larger down payment often means lower monthly payments and better interest rates.

- Trade-Ins: If you’re upgrading, trading in an older truck can offset the cost of the new purchase.

- Budgeting for Down Payments: Carefully planning a down payment can reduce the overall cost of the loan.

Using trade-ins and down payments strategically can help improve loan terms and make financing more affordable.

Alternative Financing Options for Tow Truck Businesses

In addition to traditional and specialized loans, there are several alternative financing routes:

- Business Line of Credit: Allows you to borrow as needed, offering flexibility.

- Peer-to-Peer Lending: Platforms like LendingClub can provide funding through a network of individual lenders.

- Crowdfunding: While rare, some towing companies have funded projects through crowdfunding.

Alternative financing is useful for those who may not qualify for conventional loans but should be evaluated for feasibility and potential risks.

How to Qualify for Tow Truck Financing: Key Requirements

Qualifying for tow truck financing requires meeting certain criteria:

- Credit Score: A higher credit score improves approval odds and interest rates.

- Business Income: Lenders prefer stable, documented income to ensure repayment.

- Financial Documentation: Tax returns, bank statements, and business plans are typically required.

Preparing these requirements in advance can speed up the financing process and improve your chances of approval.

The Application Process for Tow Truck Financing

The application process involves several steps to ensure eligibility and loan approval:

Preparation: Gather financial documents, review your credit report, and determine your budget.

Application Submission: Apply with multiple lenders to find the best terms.

Approval and Loan Terms: Once approved, carefully review terms before signing.

Following this structured approach can help make the application process more efficient and stress-free.

Tips for Managing Tow Truck Financing and Loan Repayment

Managing your financing responsibly is essential for maintaining cash flow and avoiding debt:

- Budgeting: Create a realistic monthly budget that includes loan repayments.

- Automatic Payments: Set up auto-pay to ensure timely payments and avoid penalties.

- Credit Monitoring: Regularly check your credit report to maintain a good credit standing.

Properly managing your financing and debt can lead to future opportunities for expansion or fleet upgrades.

How Profitable is a Tow Truck Business?

The towing industry can be highly lucrative, depending on factors such as location, services offered, and operational efficiency. Tow truck businesses earn revenue by charging for services like emergency towing, repossessions, and roadside assistance. The profitability of a tow truck business largely depends on the demand in your area and your ability to market effectively.

Key Factors Affecting Profitability

- Location: A tow truck business in a city with high traffic volume, frequent accidents, or a dense population will likely see more business.

- Service Offerings: Offering specialized services like heavy-duty towing, long-distance hauling, or roadside assistance can help you increase profits.

- Pricing Strategy: Competitive pricing, along with premium services, can help you stand out in the market.

On average, a tow truck business can earn anywhere between $30,000 to $100,000 annually, depending on the volume and types of services provided.

What’s the Best Way to Make Money with a Tow Truck?

There are several strategies to boost your earnings in the tow truck industry:

- Target High-Demand Markets: Focus on areas with consistent needs for towing, like cities with heavy traffic, businesses with high parking turnover, or rural areas with frequent breakdowns.

- Offer Roadside Assistance: In addition to towing, you can provide services like jump-starts, tire changes, lockout assistance, or fuel delivery. This can generate additional income.

- Partner with Auto Repair Shops and Insurance Companies: Establishing relationships with local auto repair shops and insurance companies can lead to consistent referral business.

- Get Involved in Fleet Services: Offering towing services to large vehicle fleets, like commercial trucks or buses, can help secure long-term contracts.

How Do I Succeed in the Towing Business?

To succeed in the towing business, you need a combination of the right strategies, equipment, and customer service:

Understand the Market: Research local regulations, competitor pricing, and demand for different services.

Invest in Reliable Equipment: Regular maintenance and well-maintained trucks ensure that you can provide consistent and quality service.

Customer Service: Word of mouth is a powerful tool in this industry. Provide friendly, professional service to build a loyal customer base.

What is a Truck Loan?

A truck loan is a type of financing that allows you to borrow money to purchase a vehicle (in this case, a tow truck). The loan is typically repaid in monthly installments over a period, often with interest. When applying for a truck loan, the lender will assess your business’s financial health, credit score, and ability to repay the loan.

How to Start a Tow Truck Business with the Right Financing?

Starting a tow truck business requires a solid financial foundation. Here’s how to get the right financing:

- Business Plan: Create a detailed business plan to present to potential lenders. This should include your target market, business goals, equipment costs, and expected revenue.

- Explore Financing Options:

- Traditional Loans: Many banks offer loans for small businesses.

- Leasing: If you don’t want to buy outright, leasing a truck is an option.

- Alternative Financing: Look into peer-to-peer lending or small business grants.

- Ensure You’re Financially Prepared: Have a healthy credit score, collateral, and the necessary down payment to secure favorable terms.

Also Read: Do You Need a Motorcycle License to Finance a Motorcycle? 3 Powerful Factors Smart Lenders Consider

Used Tow Trucks for Lease: Is It Worth It?

Leasing a used tow truck can be a cost-effective way to enter the towing business without the high upfront cost of purchasing a new truck. However, it comes with both pros and cons:

Pros:

- Lower monthly payments compared to new trucks.

- Access to reliable equipment without the long-term commitment.

- Flexibility to upgrade after the lease term.

Cons:

- Higher maintenance costs for older trucks.

- Limited customization options.

If you’re starting with a limited budget, leasing a used truck might be a smart option.

Tow Truck Financing with Bad Credit: Can You Still Get a Loan?

Yes, it’s possible to secure financing with bad credit, but it might be more challenging. Here are a few options:

Look for Lenders Specializing in Bad Credit: Some lenders specialize in helping businesses with poor credit histories.

Offer a Larger Down Payment: A larger down payment reduces the risk for lenders and can increase your chances of approval.

Consider Co-signers: Having a co-signer with better credit can improve your chances of securing financing.

Guaranteed Tow Truck Financing: What Does It Mean?

“Guaranteed financing” generally refers to a loan that’s pre-approved or guaranteed by a lender, regardless of your credit history. While these loans may sound appealing, they can come with higher interest rates or hidden fees, so it’s important to read the fine print.

Used Tow Truck Financing: A Smart Investment?

Financing a used tow truck can be a great option, especially if you want to minimize costs. The key is to find a reliable truck with a solid maintenance history. Used trucks can be purchased at a fraction of the cost of new ones, making them a viable choice for new towing businesses on a budget.

How Much Does It Cost to Lease a Tow Truck?

Leasing a tow truck can cost anywhere from $1,500 to $4,000 per month, depending on the truck’s age, make, and the leasing terms. Make sure to shop around and compare offers from different leasing companies to find the best deal.

AAA Tow Truck Financing: Is It Right for You?

AAA’s financing options for tow trucks can be an attractive choice for business owners looking for competitive rates. They typically work with trusted lenders, which can provide you with flexible terms and financing solutions. However, it’s important to compare AAA financing with other traditional or specialized tow truck loan providers to make sure you’re getting the best deal. One potential benefit of working with a trusted brand like AAA is their reputation for excellent customer service and straightforward terms.

If you have a strong credit history, AAA financing may offer lower interest rates than other sources. However, for businesses with less-than-perfect credit, it might be worth exploring other options to ensure that you get the most favorable terms possible.

Tow Truck Leasing Companies: Who to Consider?

When you’re looking to lease a tow truck, selecting the right leasing company is crucial. A few well-known leasing companies specialize in tow truck leasing and offer attractive terms. Here are a few factors to consider when choosing a leasing company:

Reputation and Reliability: Ensure the company has a solid track record and good customer reviews. The leasing process should be smooth and transparent.

Lease Terms and Flexibility: Look for companies that offer flexible lease terms and the ability to purchase the truck at the end of the lease period if you choose.

Maintenance Support: Some leasing companies offer maintenance packages to help you keep your tow truck in good condition, which can be a huge advantage.

Some popular leasing companies in the tow truck industry include Ritchie Bros. Auctioneers, Penske Truck Leasing, and FleetLease, among others.

Tow Trucks for Sale: Should You Buy or Lease?

When deciding between buying or leasing a tow truck, there are several factors to consider. Both options come with pros and cons, depending on your business’s current financial situation and long-term goals.

Buying a Tow Truck

- Pros:

- Full ownership of the truck once paid off.

- No mileage limits or restrictions on customization.

- Long-term investment, especially if the truck is durable and well-maintained.

- Cons:

- High upfront costs, potentially requiring a substantial loan or down payment.

- Maintenance costs fall entirely on you once the warranty expires.

Leasing a Tow Truck

- Pros:

- Lower upfront costs and more affordable monthly payments.

- Ability to upgrade to newer models every few years.

- Less maintenance responsibility, as it’s often covered in the lease agreement.

- Cons:

- No ownership, so you don’t build equity in the truck.

- Restrictions on mileage and how the vehicle is used.

If you’re just starting out and want to keep your initial investment low, leasing could be the better option. However, if you have the capital and want to build long-term assets for your business, buying might be the smarter choice.

Read About: Do You Need Full Coverage on a Used Financed Car? 3 Smart Reasons to Consider It

Tow Truck & Wrecker Financing Loan Programs: A Closer Look

Several loan programs are designed specifically for purchasing or financing tow trucks and wreckers. These programs offer specialized terms that cater to the unique needs of businesses in the towing industry. Here are a few to consider:

- SBA Loans (Small Business Administration): SBA loans can be a great option for small business owners. They typically offer lower interest rates and longer repayment terms, making them more affordable in the long run. However, SBA loans can be challenging to qualify for, especially for new businesses.

- Equipment Financing: This type of loan is specifically designed for purchasing equipment, such as tow trucks. The truck itself serves as collateral for the loan, which means you won’t need to put up personal assets to secure financing.

- Line of Credit: If you need flexibility in your financing, a business line of credit can be useful. You can borrow as much as you need and only pay interest on the amount you use.

When applying for these loan programs, it’s important to prepare a solid business plan and demonstrate your ability to repay the loan. Good credit, a proven track record, and a clear path to profitability can increase your chances of approval.

Conclusion

Financing a tow truck can open doors for new business owners or help existing businesses expand their operations. While there are many financing options—ranging from traditional bank loans to specialized lenders and leasing—each option has its own set of advantages, requirements, and potential drawbacks.

By carefully assessing your business needs, financial situation, and long-term goals, you can choose the financing route that best supports your vision. Whether you’re just starting out or looking to upgrade your fleet, understanding these financing methods will help you secure the best possible terms, keep your business financially healthy, and set you up for future growth.

Frequently Asked Questions About Finance a Tow Truck

What credit score do I need to finance a tow truck?

While the ideal credit score varies by lender, a score of 650 or higher generally improves your chances of approval for traditional loans. Specialized lenders or bad-credit lenders may accept scores below 650, though interest rates could be higher.

Is it better to lease or buy a tow truck?

Leasing can be advantageous if you prefer lower upfront costs and the option to upgrade regularly, while buying is often more cost-effective in the long term, especially if you plan to use the truck for many years.

Can I finance a tow truck with no money down?

Some lenders may offer zero-down financing, but these loans typically come with higher interest rates and may require excellent credit. Equipment financing options can sometimes also allow lower down payments.

Accordion title How long does it take to get approved for tow truck financing?

Approval times vary by lender and loan type. Traditional bank loans can take several weeks, while specialized lenders or online applications may offer faster approval within a few days.

Can I get a tow truck loan if my business is new?

Yes, but new businesses may face additional scrutiny and may need to demonstrate a strong business plan, steady cash flow, or personal credit history. Some specialized lenders cater to startups and can provide flexible options for new business owners.

Are there tax benefits to financing a tow truck?

Yes, many financing methods allow you to deduct loan interest or lease payments as a business expense. Consult with a tax advisor to understand the specific deductions available in your situation.

What’s the difference between a personal loan and business loan for a tow truck?

A personal loan relies on your individual credit and finances, while a business loan considers your business’s financial health. Personal loans may be easier to qualify for, but they put personal assets at risk if the business struggles with payments.

Can I trade in an old tow truck as part of financing a new one?

Yes, many lenders accept trade-ins as part of the down payment for financing a new tow truck, which can reduce your loan amount and monthly payments.

What happens if I default on my tow truck loan?

Defaulting on a tow truck loan can lead to repossession of the vehicle and a negative impact on your credit score. To avoid this, communicate with your lender if you face financial difficulties—they may offer alternative repayment plans.

Do SBA loans cover tow truck financing?

Yes, SBA loans such as the 7(a) and 504 programs can be used to finance equipment, including tow trucks. These loans typically offer competitive rates and extended terms, making them a solid option for qualifying businesses.