How to Start a Business in Uruguay Step by Step: Top Powerful 10 Steps

Are you considering launching your entrepreneurial journey in Uruguay? Known for its stable economy, strategic location, and supportive business environment, Uruguay has become a hotspot for aspiring business owners. If you’ve ever wondered how to start a business in Uruguay step by step, this guide is here to help. Let’s dive into the details to make your dream a reality.

Table of Contents

- Why Choose Uruguay for Your Business?

- Step 1: Research the Market

- Step 2: Choose the Right Business Structure

- Step 3: Register Your Business Name

- Step 4: Obtain a Tax Identification Number (RUT)

- Step 5: Open a Bank Account

- Step 6: Secure Necessary Licenses and Permits

- Step 7: Hire Employees or Work Solo

- Step 8: Understand Tax Obligations

- Step 9: Leverage Free Trade Zones

- Step 10: Market Your Business

- Also Read: How to Start a Box Truck Business: 2 Smart Ways to Choose Your Perfect Box Truck Type

- Benefits of Entrepreneurship in Uruguay

- What are the challenges of doing business in Uruguay?

- How much does it cost to set up a company in Uruguay?

- Which country is easiest to start a business as a foreigner?

- Also Read: How to Sell Used Items on Amazon: Top 9 Powerful Steps

- How to start a business in Uruguay online

- How to start a business in Uruguay for foreigners

- How to Uruguay company register

- How to set up a company in Uruguay

- Conclusion

- FAQs About Start a Business in Uruguay Step by Step

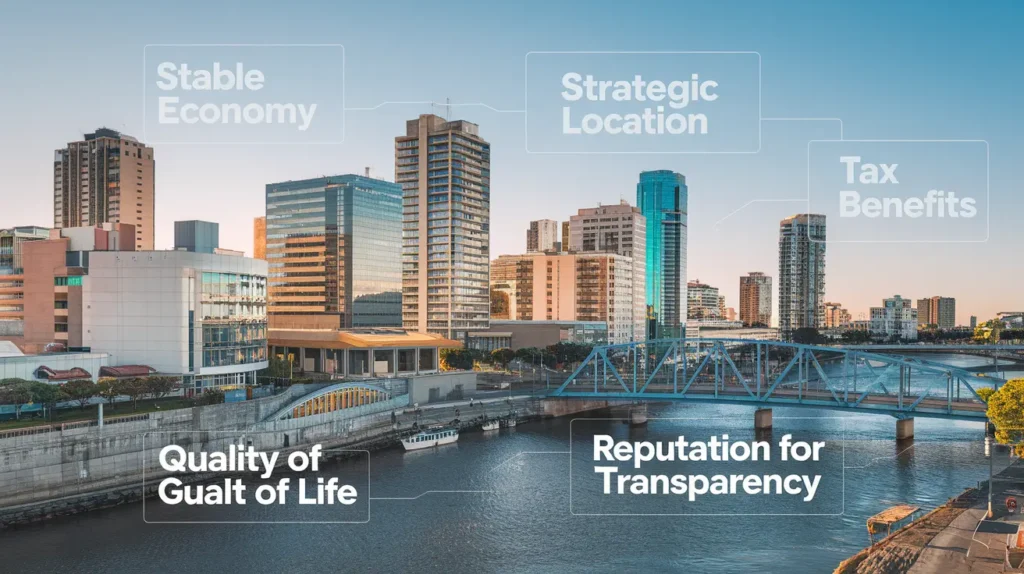

Why Choose Uruguay for Your Business?

Uruguay is more than just a picturesque country; it’s a land of opportunities for entrepreneurs. With a stable economy and transparent governance, the country offers a business-friendly climate. Its geographic location provides easy access to the rest of South America, and its free trade zones offer tax benefits that can significantly reduce your operational costs.

Step 1: Research the Market

Starting with solid market research is crucial. Identify a niche that aligns with your skills and interests. Utilize resources like the Chamber of Commerce in Uruguay or market analysis tools to understand demand, target demographics, and competition.

Step 2: Choose the Right Business Structure

Uruguay offers several business entity types, each with unique advantages:

- Sole Proprietorship: Simple and ideal for small ventures.

- Partnership: Suitable for businesses with multiple founders.

- Corporation (SA) and Limited Liability Company (SRL): Best for larger businesses needing legal protections. Selecting the right structure ensures your business is set up for success.

Step 3: Register Your Business Name

Your business name must be unique and comply with local laws. Visit the National Registry of Companies (Registro de Empresas) to check and register your name. This ensures your brand identity is legally protected.

Step 4: Obtain a Tax Identification Number (RUT)

The RUT, issued by the Dirección General Impositiva (DGI), is mandatory for all businesses in Uruguay. You’ll need identification documents, proof of address, and details about your business activities.

Step 5: Open a Bank Account

A local bank account is essential for managing finances. Banks like Banco República and Santander are popular choices. Bring your RUT, identification, and proof of business registration to streamline the process.

Step 6: Secure Necessary Licenses and Permits

Depending on your industry, specific licenses or permits may be required. For instance, food businesses need health permits, while import/export companies must comply with customs regulations.

Step 7: Hire Employees or Work Solo

Uruguay has strict labor laws to protect employees. If you plan to hire, ensure compliance with employment contracts, social security contributions, and labor rights. Alternatively, you can choose to operate as a sole proprietor.

Step 8: Understand Tax Obligations

Uruguay’s corporate tax rate is 25%, but businesses in free trade zones enjoy exemptions. Stay on top of VAT and other tax obligations by working with a local accountant.

Step 9: Leverage Free Trade Zones

Uruguay’s free trade zones provide tax incentives and access to global markets. Zones like Zonamérica and WTC Free Zone are ideal for tech and export businesses.

Step 10: Market Your Business

A robust marketing plan tailored to Uruguay’s audience is key. Leverage social media, collaborate with local influencers, and attend networking events to build your brand.

Also Read: How to Start a Box Truck Business: 2 Smart Ways to Choose Your Perfect Box Truck Type

Benefits of Entrepreneurship in Uruguay

Despite challenges, Uruguay offers a stable economy, supportive legal framework, and a high quality of life. Entrepreneurs enjoy access to regional and international markets, making it an attractive destination for business.

What are the challenges of doing business in Uruguay?

- Bureaucracy: While Uruguay is one of the easier places in Latin America to do business, navigating paperwork and permits can still be time-consuming.

- High Taxes: Businesses face corporate income tax (IRAE) at 25%, along with other taxes like VAT and social security contributions.

- Labor Laws: Strict labor regulations can make it challenging to manage workforce flexibility.

- High Costs: Utilities, rent, and labor costs can be higher compared to neighboring countries like Argentina and Brazil.

- Small Market: With a population of about 3.5 million, the market size is limited unless the business is export-focused.

How much does it cost to set up a company in Uruguay?

Costs can vary depending on the type of business structure:

- Incorporation Fee: Establishing a company (like a Sociedad Anónima, SA) may cost between $1,500 to $5,000 USD, depending on legal and notary fees.

- Initial Capital Requirement: Most company structures don’t require a high minimum capital. For SAs, it’s typically around $4,500 USD.

- Legal Representation: If you’re a foreigner, you’ll need a legal representative in Uruguay, which can cost $500–$2,000 annually.

- Accounting and Administration: Monthly accounting services may range from $200 to $500 USD.

- Annual Costs: Maintenance costs like corporate taxes, filing fees, and social security can range between $2,000 and $5,000 annually.

Why is Uruguay good for business?

- Stable Economy: Uruguay has a stable democracy and economy, offering predictability for long-term investments.

- Strategic Location: Situated between Brazil and Argentina, Uruguay provides easy access to two large markets.

- Tax Benefits: Export-oriented businesses can benefit from Uruguay’s Free Trade Zones (FTZs) with tax exemptions.

- Reputation for Transparency: Uruguay ranks high in transparency and low in corruption compared to other Latin American countries.

- Quality of Life: The country boasts a high standard of living, attracting entrepreneurs and professionals.

Which country is easiest to start a business as a foreigner?

Countries like New Zealand, Singapore, and Estonia are known for their ease of doing business. Key reasons include:

- New Zealand: Streamlined online registration process, low costs, and minimal bureaucracy.

- Singapore: Global business hub with strong infrastructure, low corporate taxes, and efficient setup procedures.

- Estonia: Pioneering e-residency program allowing foreigners to set up a business entirely online.

Uruguay ranks well in Latin America but does not match the ease of these global leaders.

Also Read: How to Sell Used Items on Amazon: Top 9 Powerful Steps

How to start a business in Uruguay online

While Uruguay doesn’t yet support fully online incorporation, some steps can be done digitally:

- Choose a Business Structure: Common types include Sociedad de Responsabilidad Limitada (SRL) and Sociedad Anónima (SA).

- Hire a Notary: Engage a local notary to draft incorporation documents. Notaries handle most administrative processes.

- Reserve a Company Name: This can be done online through the National Audit Office (Auditoría Interna de la Nación).

- Submit Documentation: Send required forms to the National Registry. Some platforms allow for digital submissions.

- Tax Registration: Register your business with the Dirección General Impositiva (DGI) and Banco de Previsión Social (BPS).

- Bank Account Setup: Open a corporate bank account for your company.

How to start a business in Uruguay for foreigners

- Legal Representation: As a foreigner, appoint a legal representative in Uruguay to handle compliance.

- Residency (Optional): Though not mandatory, obtaining residency can simplify processes like opening a bank account.

- Choose a Business Structure: Foreigners can freely choose SRL, SA, or sole proprietorship depending on their needs.

- Obtain Permits: For certain industries (e.g., agriculture or construction), you may need additional permits.

- Free Trade Zone Opportunities: Foreign entrepreneurs can take advantage of Uruguay’s FTZs for tax incentives.

Uruguay company registry search

Uruguay’s National Registry maintains records of all registered companies. To search for a company:

Visit the Auditoría Interna de la Nación (AIN) website.

Use the Registro de Empresas portal to look up businesses by name or tax ID.

Some services may require a small fee or registration to access detailed data.

How to Uruguay company register

Registering a company in Uruguay involves:

- Choose a Company Name: Verify availability through the AIN.

- Draft Bylaws: Engage a notary to create legal statutes for your business.

- Register with National Registry: Submit the notarized documents to the National Registry.

- Obtain Tax Numbers: Register with the DGI for corporate tax purposes.

- Social Security Enrollment: Enroll with BPS for social security contributions.

Uruguay SA company

The Sociedad Anónima (SA) is a common structure for larger businesses in Uruguay:

- Ownership: Shares are freely transferable, and shareholders’ liability is limited to their contributions.

- Management: Requires a board of directors and a statutory auditor.

- Tax Benefits: Ideal for export businesses due to incentives under FTZs.

- Cost: Higher initial setup and annual maintenance costs compared to an SRL.

Uruguay business opportunities

Some promising sectors in Uruguay include:

Agriculture: High demand for export-quality beef, soy, and dairy.

Renewable Energy: Uruguay is a global leader in clean energy and offers opportunities in wind and solar power.

Tech Startups: Government incentives and a growing tech talent pool make it a hotspot for software and IT businesses.

Tourism: Ecotourism and luxury tourism along the coast remain growth areas.

How to set up a company in Uruguay

- Decide on the Business Type:

- SRL: Best for small to medium businesses with fewer compliance requirements.

- SA: Suited for larger companies or those requiring shareholder flexibility.

- Draft Legal Documents: Engage a notary to prepare bylaws or articles of incorporation.

- File Documents: Register with the AIN and obtain a registration number.

- Tax and Social Security Setup: Complete registrations with the DGI and BPS.

- Operational Licenses: Obtain specific permits if required for your industry.

- Bank Account: Open a corporate account to manage transactions.

Conclusion

Starting a business in Uruguay step by step requires careful planning, but the rewards are worth it. From choosing the right structure to leveraging free trade zones, this guide covers all the essentials. Now is the time to turn your business idea into reality in this vibrant country.

FAQs About Start a Business in Uruguay Step by Step

What is the cost of starting a business in Uruguay?

The costs depend on the business structure and industry but typically range from $500 to $2,000 for registration and initial expenses.

Can foreigners own businesses in Uruguay?

Yes, Uruguay allows foreigners to own 100% of a business without needing a local partner.

Are there incentives for startups in Uruguay?

Yes, incentives include tax exemptions in free trade zones and startup-friendly programs like ANDE (National Development Agency).

How long does it take to start a business in Uruguay?

On average, it takes 2-4 weeks to complete all the registration and licensing processes.

Do I need a local partner to start a business in Uruguay?

No, but working with a local consultant can help navigate legal and cultural nuances.