Are Real Estate and Property Taxes the Same? 3 Powerful and Effective Ways to Calculate Them

When it comes to taxation, the question arises: Are Real Estate and Property Taxes the Same? Terms like “real estate taxes” and “property taxes” are often used interchangeably, creating confusion among homeowners, investors, and anyone involved in real estate transactions. However, these two concepts, while closely related, are not necessarily the same. Understanding the nuances between real estate taxes and property taxes is crucial for making informed decisions, budgeting accurately, and ensuring compliance with local and state laws.

In this article, we will explore the definitions, distinctions, and practical implications of real estate taxes and property taxes, delving into how each affects homeowners and property owners. Whether you own a residential property, commercial building, or vacant land, clarity on these tax obligations can help you better manage your financial responsibilities.

Table of Contents

- Are Real Estate and Property Taxes the Same: Defining Real Estate Taxes and Property Taxes

- Also Read: How Many Houses Do Real Estate Agents Sell a Year?

- Are Real Estate and Property Taxes the Same: How Real Estate Taxes Are Calculated

- Are Real Estate and Property Taxes the Same: How Property Taxes Are Calculated

- Common Uses of Revenue Collected from Real Estate and Property Taxes

- Differences in Tax Liability: Residential vs. Commercial Real Estate

- Tax Rates and Assessments

- Exemptions and Reductions in Real Estate and Property Taxes

- Real Estate Taxes vs. Property Taxes: Impacts on Homeownership

- Real Estate and Property Taxes Across Different States

- Common Questions on Real Estate and Property Taxes

- Implications of Real Estate and Property Taxes for Investors

- Taxpayer Rights and Property Tax Appeals

- Future Trends in Real Estate and Property Taxation

- The Role of Real Estate and Property Taxes in Local Government Budgets

- Real Estate and Property Taxes: Key Challenges and Issues

- The Relationship Between Real Estate Market Trends and Property Taxes

- Are Real Estate Taxes the Same as Property Taxes in Texas?

- How Is a Property Tax Similar to and Different from an Income Tax (Quizlet)?

- Which State Has No Property Tax in the USA?

- What Is the Difference Between Real Estate Taxes and Property Taxes?

- A Tax on Real Estate or Personal Property Is Called

- What’s the Difference Between Real Estate Tax, Property Tax, and Personal Property Tax (10 Steps)?

- Conclusion: Are Real Estate and Property Taxes the Same?

- Frequently Asked Questions (FAQs) on Are Real Estate and Property Taxes the Same?

- Can property taxes change from year to year?

- What is the difference between an assessment and an appraisal?

- Are there penalties for not paying property taxes?

- How are commercial and residential real estate taxes different?

- Can real estate taxes be paid in installments?

- How do local governments determine the millage rate?

- What happens if my property assessment is incorrect?

- Do real estate and property taxes apply to rental properties?

Are Real Estate and Property Taxes the Same: Defining Real Estate Taxes and Property Taxes

What Are Real Estate Taxes?

Real estate taxes are taxes imposed by local, state, or federal governments on real property, which typically includes land and any permanent structures attached to it, such as homes, buildings, or improvements like driveways.

The funds collected from real estate taxes are generally used to support public services, such as schools, roads, emergency services, and local infrastructure projects. Real estate taxes are assessed based on the value of the property, which is determined by an assessment conducted by the local taxing authority.

What Are Property Taxes?

Property taxes are a broader category of taxes levied on various types of property, not limited to real estate. In addition to land and buildings, property taxes can apply to tangible personal property (such as vehicles, boats, or business equipment) and, in some jurisdictions, intangible assets.

The definition and scope of what is taxed as “property” can vary by state and locality. In many cases, property taxes encompass real estate taxes as a subcategory.

Also Read: How Many Houses Do Real Estate Agents Sell a Year?

Key Takeaway: Real Estate Taxes vs. Property Taxes

While all real estate taxes are a form of property tax, not all property taxes are limited to real estate. Property taxes have a broader scope, encompassing tangible and, sometimes, intangible assets, whereas real estate taxes specifically pertain to land and structures attached to the land.

Are Real Estate and Property Taxes the Same: How Real Estate Taxes Are Calculated

Assessing the Value of Real Estate

Real estate taxes are calculated based on the assessed value of the property. Assessors from the local taxing authority determine the market value of the property, which may involve evaluating recent sales of comparable properties, the condition of the structure, and other factors that affect value.

Tax Rates and Millage Rates

The amount of real estate tax owed is typically calculated by multiplying the assessed value by the applicable tax rate. The rate is often expressed as a millage rate, which represents the amount of tax payable per $1,000 of assessed value. For example, if the millage rate is 20 mills (or 2%), and the assessed property value is $100,000, the annual real estate tax would be $2,000.

Exemptions and Reductions

Many jurisdictions offer exemptions or reductions in real estate taxes for certain groups, such as senior citizens, veterans, and individuals with disabilities. Homestead exemptions, which reduce the taxable value of a primary residence, are also common.

Are Real Estate and Property Taxes the Same: How Property Taxes Are Calculated

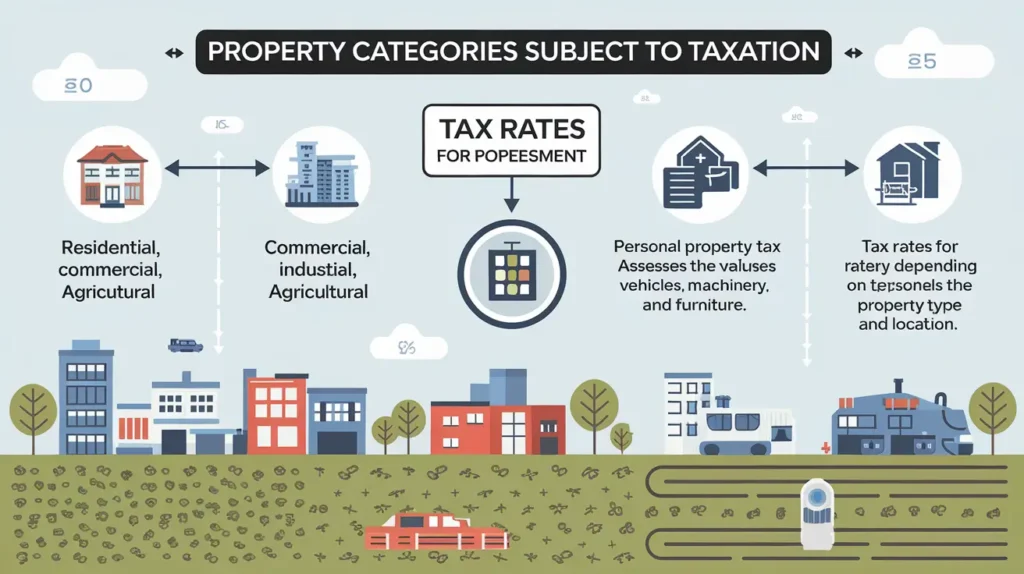

Property Categories Subject to Taxation

Unlike real estate taxes, property taxes encompass a wider range of taxable items. In addition to real property, jurisdictions may impose taxes on personal property, such as:

- Motor vehicles

- Boats and recreational vehicles

- Business inventory and equipment

- Machinery used in commercial settings

Personal Property Tax Assessment

Tangible personal property is usually assessed differently than real estate. For example, the value of a vehicle may be determined using depreciation schedules or market values provided by automotive guides. Local governments establish rules for how and when personal property taxes are assessed and collected.

Tax Rates for Personal Property

Tax rates for tangible personal property may differ from those applied to real estate, depending on the type of asset, its value, and the local taxing authority’s regulations. For example, a state may have separate tax rates for business equipment versus residential property.

Common Uses of Revenue Collected from Real Estate and Property Taxes

Funding Public Schools and Education Programs

A significant portion of real estate and property tax revenue is often allocated to local school districts. These funds help finance public education, including teacher salaries, school infrastructure, technology, and extracurricular programs.

Public Infrastructure and Services

Real estate and property taxes provide essential funding for local infrastructure, such as roads, bridges, utilities, public transportation, and parks. Taxes collected also support public safety services, including police, fire departments, and emergency medical services.

Local Government Operations

Municipalities rely on real estate and property tax revenue to cover their operating budgets, which may include administrative costs, community programs, and public health initiatives.

Differences in Tax Liability: Residential vs. Commercial Real Estate

Tax Rates and Assessments

The tax rates and assessment procedures for residential and commercial properties often differ. Commercial properties may be subject to higher tax rates and stricter assessments, given their income-generating potential.

Depreciation and Deductions

Commercial property owners may qualify for deductions related to depreciation, operating expenses, and improvements. These deductions can reduce the overall tax burden but come with specific requirements and limitations.

Zoning and Special Tax Districts

In some areas, commercial properties located in special tax districts, such as Business Improvement Districts (BIDs), may be subject to additional levies that fund local improvements, marketing, and safety initiatives.

Exemptions and Reductions in Real Estate and Property Taxes

Homestead Exemptions

Homestead exemptions reduce the taxable value of a primary residence, resulting in lower real estate taxes. This exemption is often offered to residents who own and occupy their homes.

Senior Citizen and Veteran Exemptions

Special tax exemptions or reductions may be available to senior citizens, veterans, or individuals with disabilities, depending on local laws.

Agricultural and Conservation Land Exemptions

Properties used for farming, conservation, or environmental preservation may qualify for reduced tax rates to encourage sustainable land use.

Real Estate Taxes vs. Property Taxes: Impacts on Homeownership

Annual Tax Bills and Budgeting

Homeowners should budget for annual real estate tax bills based on the assessed value of their property and applicable tax rates. Failure to pay these taxes can lead to liens, fines, or foreclosure.

Tax Deductions for Homeowners

In the U.S., taxpayers can deduct state and local property taxes (including real estate taxes) on their federal income tax returns, up to a specified limit. This deduction can provide significant financial relief for homeowners.

Tax Implications for Homebuyers and Sellers

During real estate transactions, unpaid real estate taxes are often prorated between buyers and sellers. Understanding the tax history of a property is essential for prospective buyers to avoid unexpected liabilities.

Real Estate and Property Taxes Across Different States

Variation in Tax Rates

Tax rates for real estate and property taxes vary widely across states and localities. Some states have relatively low real estate taxes but higher personal property taxes, while others rely more heavily on real estate tax revenue.

State-Specific Rules and Regulations

States have unique rules regarding exemptions, deductions, and the types of property subject to taxation. Familiarity with these rules is crucial for property owners to ensure compliance and take advantage of available tax breaks.

Common Questions on Real Estate and Property Taxes

A. Are real estate taxes and property taxes the same?

Not exactly. Real estate taxes refer specifically to taxes levied on land and structures, while property taxes encompass a broader range of assets, including tangible personal property like vehicles and business equipment.

B. How often are real estate and property taxes assessed?

Assessments typically occur annually or semi-annually, depending on local government practices. Some jurisdictions may reassess property values more frequently based on market changes.

C. Can property taxes be appealed?

Yes. Property owners can appeal their tax assessments if they believe the assessed value is too high. The process usually involves presenting evidence, such as comparable property values or appraisal reports.

D. Do all states have the same property tax system?

No. Each state sets its own rules, rates, and assessment practices for real estate and property taxes. Local jurisdictions within a state may also have unique regulations.

E. Are there tax benefits for energy-efficient home improvements?

In some states, homeowners who make energy-efficient upgrades to their properties may qualify for tax credits or exemptions that reduce their real estate tax burden.

Implications of Real Estate and Property Taxes for Investors

A. Understanding Property Tax Liabilities for Investment Properties

Real estate investors must factor in property tax liabilities when evaluating the profitability of an investment. Property taxes can significantly impact the net operating income (NOI) of rental properties and commercial buildings. High tax rates can reduce cash flow, while areas with favorable tax rates may offer better investment returns.

B. Tax Considerations for Real Estate Flippers

Investors who buy and sell properties (often known as “flippers”) must understand how real estate taxes will impact their holding costs during the renovation period. Flippers should budget for real estate taxes during the time they own the property and consider any potential tax increases after improvements are made.

C. Depreciation Deductions for Commercial Real Estate

Commercial real estate owners may benefit from depreciation deductions that reduce taxable income. Depreciation reflects the gradual wear and tear on a property and can offset the impact of property tax liabilities. However, depreciation recapture rules may apply if the property is sold.

D. The Role of Location in Investment Decisions

Property taxes vary by state, county, and even neighborhood. Investors should research local tax rates and assessment practices to avoid surprises and ensure that the tax environment aligns with their investment goals. High property taxes may deter potential buyers or tenants, affecting the property’s marketability.

E. Strategies to Minimize Property Tax Burden

Investors can employ various strategies to minimize their property tax burden, such as appealing assessments, exploring tax incentives or credits for improvements, and participating in state programs that offer relief for specific types of properties (e.g., low-income housing tax credits).

Real Estate and Property Taxes for Businesses

A. Property Tax Considerations for Business Owners

Businesses that own real estate must consider property taxes as part of their overall operating costs. These taxes can significantly impact profitability, especially for small businesses with limited resources. Properly budgeting for property taxes is essential for maintaining financial health.

B. Taxes on Tangible Personal Property Used by Businesses

Many states impose taxes on tangible personal property used in business operations, such as equipment, machinery, and office furniture. Businesses should be aware of the taxable value of these assets and understand the rules governing assessments, depreciation, and exemptions.

C. Lease Agreements and Property Tax Responsibilities

Business tenants leasing commercial space may be responsible for a share of the property taxes, depending on the terms of their lease agreement. Triple net (NNN) leases, for example, typically require tenants to pay for property taxes, insurance, and maintenance in addition to rent. Understanding these obligations is crucial for budgeting and cost control.

D. Impact of Property Taxes on Business Expansion Decisions

When planning to expand or relocate, businesses must consider the property tax implications of different locations. Areas with high property taxes may offset other advantages, such as proximity to customers or suppliers, making it essential to evaluate the overall tax climate.

Taxpayer Rights and Property Tax Appeals

A. Right to Appeal Property Tax Assessments

Property owners have the right to appeal their property tax assessments if they believe the assessed value is inaccurate or excessive. This process typically involves submitting a formal appeal, providing evidence to support a lower value (such as comparable sales data or an independent appraisal), and attending a hearing.

B. Steps to File a Property Tax Appeal

- Review the Assessment Notice: Property owners should carefully review their annual assessment notice for accuracy.

- Gather Evidence: Collect supporting documentation, such as recent sales data or an appraisal report.

- File a Formal Appeal: Submit an appeal to the appropriate local authority within the specified timeframe.

- Attend the Hearing: Present the evidence and argue the case for a lower assessment.

- Await the Decision: The appeals board will make a decision based on the evidence presented.

C. Common Reasons for Property Tax Appeals

- Inaccurate Assessments: If the property is overvalued compared to similar properties.

- Exemptions Not Applied: Failure to apply eligible exemptions.

- Errors in Property Description: Incorrect square footage or other property details.

- Market Changes: If property values have declined significantly in the area.

Future Trends in Real Estate and Property Taxation

A. Technology and Real Estate Tax Assessments

Advancements in technology are changing how property values are assessed. Automated valuation models (AVMs) and data-driven approaches may streamline the assessment process but could lead to disputes if taxpayers feel their property is inaccurately valued.

B. Changes in Tax Laws and Policies

Tax laws and policies governing real estate and property taxes are subject to change. Property owners should stay informed about legislative updates that may impact their tax liabilities, such as changes to assessment practices, tax caps, or new exemptions.

C. Impact of Climate Change on Property Taxation

As climate change affects coastal and disaster-prone areas, governments may impose additional taxes or assessments to fund resilience and mitigation efforts. Property owners in vulnerable areas should be aware of these potential changes and how they may impact taxes.

D. Increasing Focus on Environmental and Sustainable Practices

Local governments may offer tax incentives to encourage environmentally friendly practices, such as installing solar panels or using energy-efficient building materials. Real estate and property taxes can play a role in promoting sustainability through financial incentives.

Navigating Real Estate and Property Taxes: Tips for Homeowners and Businesses

A. Stay Informed About Local Tax Policies

Understanding local tax policies and how they affect your property is crucial. Regularly review tax notices, attend town hall meetings, and consult with tax professionals to stay up to date on changes that may impact your taxes.

B. Take Advantage of Available Exemptions

Many jurisdictions offer tax exemptions or credits for homeowners, veterans, and certain businesses. Researching and applying for these exemptions can reduce your tax burden.

C. Maintain Accurate Property Records

Ensure that your property records with the taxing authority are accurate. Errors in the description or value of the property can lead to incorrect assessments and higher taxes.

D. Work with a Tax Professional

Consulting with a tax professional who specializes in real estate and property taxes can help you navigate complex regulations, file appeals, and optimize your tax strategy.

The Role of Real Estate and Property Taxes in Local Government Budgets

A. Critical Source of Revenue for Localities

Real estate and property taxes represent a primary source of revenue for local governments, often accounting for a substantial portion of their budgets. These taxes fund essential services and infrastructure, such as education, road maintenance, emergency services, public safety, and municipal operations. Without revenue from these taxes, local governments would struggle to provide services that are critical for residents’ quality of life.

B. Allocation of Tax Revenue

The allocation of real estate and property tax revenue typically varies based on local needs and priorities. Here are common areas where tax dollars are used:

- Public Schools: A significant share of property tax revenue goes toward funding public schools, including teacher salaries, facility maintenance, and educational programs.

- Public Safety: Fire departments, police departments, and emergency medical services often rely on tax revenues to operate and maintain essential equipment and staffing levels.

- Infrastructure Projects: Real estate and property tax revenue supports the construction and maintenance of infrastructure such as roads, bridges, utilities, and public buildings.

- Local Government Services: Municipal operations, such as public health initiatives, waste management, and community development projects, depend on tax funding.

C. Economic Impacts of Tax Rate Changes

Changes in real estate and property tax rates can have significant economic impacts on local communities. For example:

- Higher Tax Rates: Increasing property tax rates may provide additional revenue for essential services, but they can also place a financial burden on property owners and potentially discourage new business investment.

- Lower Tax Rates: Reducing property taxes may attract new residents and businesses but could lead to underfunding of public services.

Real Estate and Property Taxes: Key Challenges and Issues

A. Property Tax Inequities

One of the major issues surrounding property taxes is inequity in assessments. Variations in assessment practices, outdated valuation data, and market disparities can lead to unequal tax burdens among property owners. This issue often disproportionately affects residents of different neighborhoods, leading to calls for assessment reforms.

B. Rising Tax Bills and Affordability Concerns

In rapidly growing markets, the assessed value of real estate can increase significantly, leading to higher tax bills. Homeowners, particularly those on fixed incomes, may find it challenging to keep up with rising taxes. Local governments sometimes offer relief programs, such as “circuit breaker” programs, to cap the tax burden for low-income households.

C. Delinquent Property Taxes and Liens

Failure to pay real estate or property taxes can result in liens placed on the property, affecting the owner’s ability to sell or refinance. In extreme cases, delinquent taxes can lead to foreclosure. Local governments may offer payment plans or tax relief programs to assist struggling taxpayers.

D. Tax Implications for Environmental and Climate Change Initiatives

As environmental concerns grow, some governments are considering property taxes that encourage sustainable land use or penalize practices that harm the environment. For example, green incentives or penalties related to energy consumption, pollution, or land development can affect how property taxes are applied.

E. Appeals and Administrative Challenges

The process of appealing property tax assessments can be complex, and the volume of appeals can overwhelm local tax offices. Simplifying the appeals process and ensuring transparency in assessments are common goals of property tax reform efforts.

Real Estate and Property Tax Planning Strategies

A. Research Local Tax Rates Before Buying Property

When buying property, it’s important to research local tax rates, assessment practices, and any anticipated changes in tax policies. High property taxes in an area can affect long-term affordability and overall return on investment.

B. Explore Exemptions and Deductions

Homeowners and businesses should explore all applicable exemptions and deductions that can lower their tax liabilities. For example, homestead exemptions, agricultural exemptions, and deductions for energy-efficient improvements can offer substantial savings.

C. Monitor Changes in Property Value Assessments

Staying informed about changes in property value assessments is crucial for budgeting and financial planning. Regularly checking assessment notices and disputing inaccuracies can help prevent overpayment of taxes.

D. Consider Tax-Advantaged Real Estate Investments

Investing in tax-advantaged properties, such as low-income housing or designated opportunity zones, can offer significant tax incentives. Real estate investment trusts (REITs) and other structured investment vehicles may also provide tax benefits to investors.

E. Engage a Real Estate Tax Professional

Tax professionals specializing in real estate and property taxes can provide guidance on how to minimize tax burdens, identify opportunities for savings, and navigate complex regulations. Their expertise can be especially valuable for high-value properties or large portfolios.

The Relationship Between Real Estate Market Trends and Property Taxes

A. Rising Home Values and Increased Tax Assessments

In a strong real estate market, property values tend to rise, which can lead to increased assessments and higher property taxes. While this may indicate a thriving local economy, it can also create challenges for homeowners who face sudden increases in their tax bills.

B. Market Declines and Tax Adjustments

During market downturns, property values may decline, potentially leading to lower assessments and reduced tax bills. However, the timing and accuracy of these adjustments can vary, causing frustration for property owners who feel their taxes remain too high.

C. Real Estate Development and Tax Revenue Growth

New real estate developments, such as residential subdivisions, commercial centers, and mixed-use projects, often boost property tax revenues for local governments. The increased revenue can be used to improve infrastructure and services, further enhancing the appeal of the area.

D. Gentrification and Property Tax Displacement

Gentrification in urban areas can lead to rising property values and increased tax burdens, potentially displacing long-time residents. Efforts to address displacement through tax relief measures, such as tax abatements or deferred payment programs, are often explored by local governments.

Are Real Estate Taxes the Same as Property Taxes in Texas?

In Texas, real estate taxes and property taxes are essentially the same thing. Property taxes refer to the taxes that homeowners and property owners pay based on the value of their property. Real estate taxes are specifically a subset of property taxes, applied to real property (land and buildings). So, in Texas, the term “real estate taxes” is often used interchangeably with “property taxes.”

How Is a Property Tax Similar to and Different from an Income Tax?

Similarities:

Both property taxes and income taxes are forms of taxation levied by local or state governments to generate revenue.

Both taxes are based on some form of value: property taxes are based on the value of the property you own, while income taxes are based on the income you earn.

Differences:

Property taxes are assessed annually and are tied to the ownership of a property (land, buildings, etc.), while income taxes are assessed based on annual income from work, investments, or other sources.

Property taxes are typically collected by local governments (city, county, etc.), whereas income taxes are typically collected by federal and state governments.

Property taxes are relatively stable unless the value of the property changes, while income taxes can fluctuate yearly based on your earnings.

How Is a Property Tax Similar to and Different from an Income Tax (Quizlet)?

Quizlet definitions often emphasize that while both are taxes used to fund government operations, property taxes are location-based, imposed on real estate or personal property, and are calculated based on the value of the property. Income taxes, on the other hand, are imposed on an individual’s or business’s earnings, not tied to property ownership.

Which State Has No Property Tax in the USA?

There is no state in the U.S. that entirely eliminates property taxes. However, certain states have no state-level property tax, or they have minimal property taxes:

- Alaska: While the state doesn’t impose a state-level property tax, local governments may still charge property taxes.

- Hawaii: The property tax rate is low, and it’s considered one of the lowest in the country.

- Wyoming: This state has very low property taxes and does not levy a state income tax.

In these states, property taxes are still imposed locally (by counties or municipalities), but the state does not levy a tax on property directly.

Real Estate Taxes vs Property Taxes: Key Differences Explained

Real Estate Taxes are a type of property tax specifically applied to real property, such as land and the buildings on it.

Property Taxes is a broader term that can apply to all types of property, including real property (land and structures), personal property (such as vehicles or equipment), and sometimes even business assets.

In practice, when people refer to property taxes, they often mean real estate taxes, but the distinction lies in the broader scope of the term “property taxes.”

What Is the Difference Between Real Estate Taxes and Property Taxes?

The main difference is that real estate taxes are a form of property tax applied specifically to real property (land and buildings), while property taxes can refer to taxes on any type of property, including personal property (e.g., vehicles, boats, machinery). Real estate taxes are a specific subset of property taxes.

Real Estate Taxes vs Personal Property Taxes

- Real Estate Taxes are assessed on real property (land and buildings).

- Personal Property Taxes are assessed on movable property (personal property) such as cars, boats, machinery, or business equipment.

In many areas, personal property taxes apply to tangible goods that are owned by individuals or businesses, while real estate taxes apply only to land and structures.

1098 Real Estate Taxes vs Property Taxes

- Form 1098: This form is used for mortgage interest reporting, including real estate taxes that the mortgage lender may have paid on behalf of the borrower. Real estate taxes typically refer to taxes on real property.

- Property Taxes: This is the broader term that includes both real estate taxes and personal property taxes. When filing taxes, real estate taxes paid on your home can be deductible if you itemize deductions, but personal property taxes may also be eligible for deductions, depending on the circumstances.

What Are Real Estate Taxes on Mortgage?

Real estate taxes on a mortgage are typically paid through escrow by your mortgage lender. When you pay your monthly mortgage, part of the payment goes into an escrow account, and the lender uses that money to pay your property taxes (real estate taxes) when they are due. This ensures that your property taxes are paid on time, and you don’t have to handle them directly.

A Tax on Real Estate or Personal Property Is Called

A tax on real estate (land and buildings) is generally called a real estate tax, whereas a tax on personal property (e.g., vehicles, equipment, or business assets) is called personal property tax. Both are forms of property tax.

Real Estate Tax Definition

Real estate tax refers to a tax levied on real property, which includes land and the structures built on it. These taxes are typically imposed by local governments (cities, counties, or municipalities) and are used to fund public services like schools, public safety, and infrastructure.

Real Estate Taxes on Tax Return

Real estate taxes that you pay on your property can potentially be deducted from your income taxes if you itemize your deductions on your federal tax return. You may also need to report them if you are claiming them as part of your mortgage interest deductions, depending on the amount of property tax paid and the nature of your situation.

Real Estate Taxes

Real estate taxes are taxes assessed by local governments on the value of real property (land and buildings). They are based on the value of the property and are used to fund public services at the local level.

Property Tax Tax Deductible

Yes, property taxes (including real estate taxes) can be deductible on your income taxes if you itemize your deductions. This deduction is typically subject to the SALT (State and Local Tax) cap, which limits the total amount of state and local taxes (including property taxes) that can be deducted from your federal tax return. As of 2024, the SALT cap is $10,000 for individuals and married couples filing jointly.

Is Property Tax Deductible?

Yes, property taxes are generally deductible from your federal income taxes, but only if you itemize your deductions. The deduction is available for real estate taxes paid on property you own, but personal property taxes may also be deductible in some circumstances. Always consult with a tax advisor to understand the specifics of your situation.

What’s the Difference Between Real Estate Tax, Property Tax, and Personal Property Tax (10 Steps)?

- Real Estate Tax: Imposed on land and buildings, assessed by local governments.

- Property Tax: A broad term that encompasses taxes on real property and personal property.

- Personal Property Tax: Imposed on movable property such as vehicles, boats, and machinery.

- Real Estate Taxes: Are specific to land and structures and are typically calculated based on the property’s assessed value.

- Property Taxes: Can include taxes on real property, as well as personal property, business property, etc.

- Local vs. State Taxes: Property taxes (both real estate and personal property) are usually local taxes, while real estate taxes apply specifically to real property.

- Deductibility: Real estate taxes may be deductible on your tax return, but personal property taxes are generally only deductible under certain conditions.

- Assessment: Real estate taxes are based on the assessed value of the land and any structures on it, while personal property taxes are based on the value of movable goods.

- Escrow: Real estate taxes may be paid through escrow by mortgage lenders, while personal property taxes are usually paid directly by the owner.

- Use of Funds: Both real estate taxes and personal property taxes are used to fund local government services like schools, roads, and emergency services.

Conclusion: Are Real Estate and Property Taxes the Same?

In conclusion, Are Real Estate and Property Taxes the Same? While the terms are often used interchangeably, they have distinct differences that every homeowner, business owner, and investor should understand.

Real estate taxes focus on land and structures, while property taxes may extend to personal property as well. Gaining clarity on how these taxes are assessed and applied helps property owners manage their finances effectively, leverage exemptions, and stay compliant with local laws. A solid understanding of these obligations is vital for making informed decisions and achieving financial stability.

Frequently Asked Questions (FAQs) on Are Real Estate and Property Taxes the Same?

Can property taxes change from year to year?

Yes, property taxes can change annually based on changes in property assessments, tax rates, and any new local government policies. Rising property values often lead to higher tax bills.

What is the difference between an assessment and an appraisal?

An assessment determines the taxable value of a property for tax purposes, conducted by a government assessor. An appraisal estimates the market value of a property for purposes such as buying, selling, or financing, conducted by a licensed appraiser.

Are there penalties for not paying property taxes?

Yes, failure to pay property taxes can lead to penalties, interest charges, liens on the property, and, in some cases, foreclosure.

How are commercial and residential real estate taxes different?

Commercial properties often have higher tax rates than residential properties. The assessment process may also differ, and commercial property owners may be eligible for different deductions or depreciation benefits.

Can real estate taxes be paid in installments?

Many local governments offer installment plans to allow property owners to pay their taxes in smaller amounts over a specified period, making it easier to manage payments.

How do local governments determine the millage rate?

The millage rate is determined by local government bodies, such as city councils or county commissions, based on budgetary needs and revenue requirements.

What happens if my property assessment is incorrect?

If you believe your property assessment is incorrect, you can file an appeal with the local assessor’s office. This process typically involves submitting supporting documentation and attending a hearing.

Do real estate and property taxes apply to rental properties?

Yes, landlords are responsible for paying real estate taxes on rental properties. The cost of these taxes may be factored into rental prices charged to tenants.