Home Insurance Claim Adjuster Secret Tactics: 5 Powerful Secret Tactics

Home Insurance Claim Adjuster Secret Tactics can sometimes make the claims process more complex than homeowners anticipate. While many people trust that filing a claim will be straightforward and fair, insurance adjusters often use specific strategies to minimize payouts. Knowing these tactics is crucial to ensuring your claim is handled fairly and you receive the compensation you deserve.

In this article, we’ll explore the secret tactics used by insurance adjusters, the challenges homeowners may encounter, and effective strategies to navigate the claims process with confidence.

Table of Contents

- Understanding the Role of a Home Insurance Claim Adjuster

- Secret Tactics Used by Insurance Adjusters

- How to Defend Against These Tactics

- The Importance of Legal Advice and Assistance

- How to Protect Yourself and Get a Fair Settlement

- How to Prevent Common Pitfalls in the Claims Process

- Also Read: Why Insurance Wont Cover PRP Treatments: Understanding 4 Critical Reasons

- The Power of Persistence: How to Keep the Pressure on Adjusters

- What to Do if the Insurance Company Denies Your Claim

- How to beat the insurance adjuster?

- How to get the most out of a home insurance claim?

- How do I argue with my home insurance adjuster?

- What to tell a home insurance adjuster?

- 10 Must-Know Home Insurance Claim Adjuster Secret Tactics

- Dealing with an insurance adjuster after water damage

- What home insurance adjusters won’t tell you

- Home insurance claim adjuster secret tactics (California Specific)

- Best home insurance claim adjuster secret tactics

- Car insurance claim adjuster secret tactics

- Home insurance payout instead of repair

- What happens after the home insurance adjuster comes out?

- How to scare an insurance adjuster

- Does homeowners insurance cover water damage?

- Average insurance payout for water damage

- 10 Tips to Scare Your Insurance Adjuster

- Conclusion: Home Insurance Claim Adjuster Secret Tactics

- FAQs: Home Insurance Claim Adjuster Secret Tactics

- Q1: What is the role of a home insurance claim adjuster?

- Q2: Are insurance adjusters trained to minimize claims payouts?

- Q3: What is a “lowball offer,” and why do adjusters make them?

- Q4: Can an adjuster deny my claim based on policy exclusions?

- Q5: What should I do if the insurance company delays my claim?

- Q6: How can I avoid being taken advantage of by an insurance adjuster?

- Q7: Should I hire a public adjuster?

- Q8: How do I know if the insurance adjuster’s assessment is accurate?

- Q9: Can I appeal a denied claim?

- Q10: What are the common mistakes homeowners make during the claims process?

- Q11: How long does the home insurance claim process take?

- Q12: Can I get compensation for temporary housing if my home is uninhabitable?

Understanding the Role of a Home Insurance Claim Adjuster

a. What Does an Insurance Adjuster Do?

Insurance adjusters are professionals employed by insurance companies to assess the damage reported in a claim and determine the amount of compensation a policyholder should receive. Their primary role is to evaluate the loss, review policy terms, and decide on the value of the claim. This section will discuss:

- How adjusters assess damage and losses

- The types of claims an adjuster might handle (e.g., fire, water damage, theft)

- The relationship between adjusters and the insurance company

b. Insurance Adjusters’ Interests: Protecting the Insurer’s Bottom Line

Although adjusters are required to be impartial, their primary duty is to the insurance company. This means their goal is often to minimize the payout on a claim, which can lead them to employ tactics that favor the insurer. In this section, we’ll discuss:

- How insurance companies profit from reducing payouts

- Common tactics used by adjusters to lower claim amounts

- The potential conflicts of interest that exist

Secret Tactics Used by Insurance Adjusters

a. Lowball Offers: The Common Adjuster Tactic

One of the most common tactics used by insurance adjusters is offering a low settlement right after the claim is filed. This tactic is designed to quickly close the case before the homeowner can fully assess the extent of their damages. In this section, we will explore:

- How lowball offers work

- Why adjusters make initial offers that may seem too good to be true

- The risks of accepting an early settlement

b. Delaying the Claims Process

Another tactic that adjusters may use is deliberately delaying the claims process to wear down homeowners and force them to accept lower settlements. The longer the process takes, the more likely a homeowner might get frustrated or financially desperate. This section covers:

- Reasons for claim delays

- How delays impact the homeowner’s ability to negotiate

- How to identify and handle delays in the process

c. Incomplete Damage Assessment

Sometimes, insurance adjusters may intentionally leave out some damage from their report or downplay its significance. This tactic can drastically reduce the compensation offered to the homeowner. This section will explain:

- How damage assessments are conducted

- Common instances where adjusters fail to properly assess the damage

- The steps homeowners can take to ensure a thorough evaluation

d. Asking Leading Questions to Undermine Your Claim

Insurance adjusters often ask specific questions in ways that may lead homeowners to provide answers that could reduce the claim payout. This tactic is a subtle but effective way of minimizing the insurer’s liability. In this section, we discuss:

- Types of leading questions adjusters might ask

- How these questions can work against your claim

- How to respond to adjusters in a way that protects your claim

e. Using a Policy’s Fine Print Against You

Insurance policies are filled with fine print that many homeowners don’t fully understand. Adjusters may rely on these clauses to deny or reduce claims. This section will highlight:

- Common policy exclusions that adjusters may use

- How adjusters use policy wording to deny coverage

- Steps to take to ensure you understand your policy and protect your claim

How to Defend Against These Tactics

a. Document Everything Thoroughly

The most powerful weapon homeowners have when dealing with insurance adjusters is detailed documentation. Keeping an accurate record of the damage and repair estimates can prevent adjusters from undervaluing the claim. In this section, we’ll explore:

- The types of documentation you should gather (e.g., photos, repair estimates, receipts)

- How to keep track of communication with the adjuster

- The importance of professional inspections and third-party assessments

b. Don’t Settle for the First Offer

Homeowners should always be cautious about accepting the first offer presented by an insurance adjuster. While the initial offer may seem appealing, it’s often much lower than what is owed. This section will cover:

- Why adjusters make low initial offers

- How to evaluate whether an offer is fair

- How to negotiate effectively with an adjuster

c. Hiring a Public Adjuster to Advocate for You

Public adjusters are independent professionals who represent homeowners in insurance claims. Unlike insurance adjusters, public adjusters work for the policyholder, not the insurer. This section explores:

- The role of public adjusters in the claims process

- How public adjusters can help maximize your claim

- How to choose the right public adjuster

d. Understanding Your Policy and Coverage Limits

Knowing the specifics of your home insurance policy is crucial in defending against adjusters’ tactics. Homeowners should understand their coverage limits, exclusions, and deductibles before filing a claim. This section will discuss:

- Key terms to look for in your policy

- How to spot gaps in your coverage

- How to ensure that your policy provides adequate protection

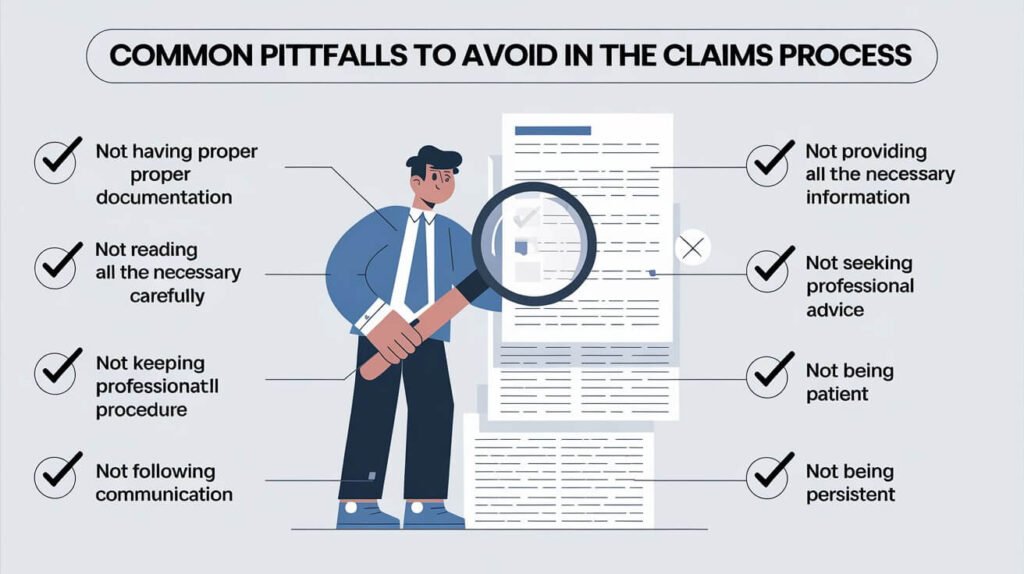

e. Avoiding Common Mistakes During the Claims Process

Many homeowners inadvertently make mistakes during the claims process that can work against them. In this section, we will review common mistakes to avoid, including:

- Failing to report damage promptly

- Providing incomplete or inaccurate information to adjusters

- Not getting professional repairs or assessments

The Importance of Legal Advice and Assistance

a. When to Consult an Attorney

If your home insurance claim is being unfairly contested or if you believe your claim is being undervalued, seeking legal advice can be beneficial. In this section, we’ll discuss:

- When to hire an attorney during the claims process

- How an attorney can help you understand your legal rights

- The potential for litigation if a settlement is not reached

b. How Legal Assistance Can Help Negotiate a Fair Settlement

Attorneys with experience in insurance law can help homeowners negotiate a more favorable settlement. This section covers:

- How legal representation strengthens your position with the insurer

- The role of attorneys in dispute resolution

- The potential benefits of litigation in extreme cases

How to Protect Yourself and Get a Fair Settlement

a. Building a Strong Case Before Filing a Claim

The key to navigating the home insurance claims process lies in building a strong case from the start. Homeowners should document the damage thoroughly and gather all supporting evidence before submitting their claim. This section will discuss:

- How to organize your case for a smooth claim process

- The importance of obtaining professional estimates for repairs

- How to avoid missing out on necessary repairs

b. Staying Calm and Informed During the Process

It’s important to stay level-headed and informed while working with an insurance adjuster. Knowing your rights and remaining patient during negotiations can help you avoid being taken advantage of. This section will explain:

- How to manage stress and anxiety during the claims process

- The importance of clear communication and professionalism

- How to advocate for your best interests

How to Prevent Common Pitfalls in the Claims Process

a. Be Cautious with the Initial Inspection

When the insurance adjuster first arrives to inspect the damage, it’s essential to stay vigilant. While adjusters may seem helpful, remember that their role is to minimize costs for the insurer. Homeowners may not always be given the full picture of what’s covered, and adjusters may rush through the assessment. Here’s how to protect yourself:

- Don’t rush the inspection: Allow the adjuster to perform a thorough review of the damage, but don’t hesitate to ask questions about their process and findings.

- Point out every damage: Sometimes, adjusters may miss minor but important details, especially if the damage is hidden or subtle. Ensure you point out all areas affected.

- Take notes during the inspection: Record the adjuster’s observations, and make sure the report is accurate. Taking photographs and documenting every detail ensures the damage is clearly understood by both you and the insurer.

b. Keep Track of All Correspondence

Whether you’re communicating via email, phone, or in person, make sure you document every interaction with your insurance company. Clear communication will help you track progress and give you evidence should issues arise later in the process.

- Email documentation: If you’re discussing important details or negotiations, follow up on phone conversations with an email recap. This provides a written record.

- Keep all receipts and invoices: For repairs, temporary fixes, or any additional costs related to the claim, always keep copies of receipts and invoices. These documents help to substantiate your claim and ensure you’re reimbursed.

- Note the names and roles of every person you interact with at the insurance company. If something goes wrong, you’ll have a record of the people who were involved in your case.

c. Don’t Be Afraid to Get a Second Opinion

Insurance adjusters might not always spot every issue, or they may intentionally minimize the value of the damage. Hiring an independent professional, such as a contractor or engineer, to assess the damage can provide a more accurate picture of what needs to be repaired. Here’s how to proceed:

- Bring in an expert: If you suspect the adjuster missed significant damage or underestimated repair costs, hire a third-party professional to provide an evaluation. This can be especially important with structural damage or long-term issues that may not be immediately apparent.

- Consider the costs of hiring experts: While it may involve some upfront costs, having an independent assessment may help justify a higher claim payout, leading to greater compensation in the end.

- Ensure that estimates are comprehensive: Request estimates that detail every aspect of the repair, from materials to labor costs.

d. Watch Out for Depreciation Adjustments

Insurance adjusters may factor depreciation into the settlement offer, especially for personal property or home items. Depreciation refers to the reduction in value of an item over time due to wear and tear. Some adjusters might apply depreciation too heavily, lowering the amount of compensation you receive. Here’s how to address this:

- Understand replacement cost vs. actual cash value: If your policy covers replacement cost, depreciation should not be subtracted from the settlement. Actual cash value (ACV) policies, on the other hand, factor in depreciation. Review your policy to know what coverage you have.

- Negotiate for full replacement value: If you believe depreciation has been unfairly applied, negotiate for full reimbursement or insist on a more accurate assessment based on the current replacement cost.

Also Read: Why Insurance Wont Cover PRP Treatments: Understanding 4 Critical Reasons

The Power of Persistence: How to Keep the Pressure on Adjusters

a. Follow Up Consistently

Many homeowners give up too easily when dealing with insurance claims, assuming that once they file the claim, the process will unfold smoothly. However, it’s crucial to follow up consistently with the adjuster. Here’s why persistence is important:

- Regular check-ins: Call or email the adjuster to ask for status updates, especially if you feel the process is moving slowly. Being proactive shows that you’re serious and that you’re keeping track of progress.

- Don’t settle for vague responses: If you’re not getting clear answers, push for specifics about the timeline, claim process, and decision-making. Adjusters will often stall to avoid a final decision, but you have the right to know where things stand.

b. Document Everything During Negotiations

As you engage in negotiations, keep detailed records of all offers, counteroffers, and responses. Here’s how to ensure you’re not taken advantage of:

- Keep copies of written offers: Whenever an adjuster makes a settlement offer, request it in writing. This allows you to compare it with your records and avoid any confusion later.

- Stay polite but firm: During negotiations, be courteous but assertive. You want to maintain a cooperative attitude, but also show that you’re prepared to push for a fair settlement.

- Leverage the power of facts: When discussing compensation, use facts, such as third-party repair estimates, expert opinions, and documentation of your own expenses. These facts strengthen your position and help back up your claim.

What to Do if the Insurance Company Denies Your Claim

a. Understand Why Your Claim Was Denied

If your claim is denied, it’s crucial to understand the reasoning behind the decision. Insurance companies must provide a written explanation of their denial, which you can use to contest the decision. Common reasons for claim denial include:

- Policy exclusions: Your claim may be denied due to specific exclusions in your policy (e.g., natural disasters, floods, or neglect).

- Failure to meet requirements: Claims may also be denied if you didn’t comply with certain requirements, such as filing within a certain timeframe or providing documentation.

- Insufficient evidence: If the adjuster deems that you haven’t provided adequate evidence of damage, they may deny the claim.

b. Appealing the Denial

If you believe your claim was wrongfully denied, you have the right to appeal. This process involves providing additional documentation or clarification that may convince the insurer to reconsider their decision. Here’s how to handle an appeal:

- Gather more evidence: Compile all relevant documentation that supports your claim, including updated photos, repair estimates, and statements from contractors.

- Consult with a professional: Seek the advice of a public adjuster, lawyer, or other professional who specializes in insurance claims. These experts can assist in filing an appeal and fighting for a fair settlement.

- Know your rights: Be aware of the appeal process outlined in your insurance policy. Every state also has laws that govern insurance practices, so check your local regulations for additional protections.

How to beat the insurance adjuster?

- Document Everything: Take detailed photos, videos, and notes about the damage.

- Be Prepared: Know your policy inside out, including coverage limits and exclusions.

- Stay Calm: Be polite but firm. Avoid emotional reactions, as it can be used against you.

- Get a Second Opinion: If the adjuster’s estimate seems low, hire an independent adjuster or contractor to assess the damage.

- Negotiate: Don’t accept the first offer if it doesn’t fully cover your losses.

How to get the most out of a home insurance claim?

- Immediate Reporting: File the claim as soon as possible.

- Comprehensive Documentation: Provide photos, videos, receipts, and a detailed inventory of damaged items.

- Hire Experts: Bring in professionals, like contractors or public adjusters, to provide estimates.

- Be Thorough: Include every item of damage, even seemingly minor ones.

- Communicate Clearly: Respond to requests promptly and in writing to maintain a record.

How do I argue with my home insurance adjuster?

- Know Your Rights: Understand your policy to counter any misinformation.

- Present Evidence: Provide detailed documentation to support your claim.

- Challenge Low Offers: Politely request a detailed breakdown of their estimate and provide your own counter-estimate.

- Involve a Public Adjuster: If negotiations stall, hire a public adjuster to advocate on your behalf.

What to tell a home insurance adjuster?

- Stick to Facts: Only discuss the damage, not how it occurred unless asked directly.

- Be Consistent: Avoid changing your story or speculating about causes.

- Don’t Volunteer Extra Information: Only answer questions asked.

- Emphasize Impact: Explain how the damage affects your daily life, but avoid exaggeration.

10 Must-Know Home Insurance Claim Adjuster Secret Tactics

- Low Initial Offers: Adjusters often start with a low offer to test your knowledge.

- Time Pressure: They may imply you must accept quickly.

- Downplaying Damage: They might suggest the damage is less severe than it is.

- Policy Exclusion Claims: Highlighting exclusions without clear evidence.

- Partial Payments: Offering partial compensation for incomplete repairs.

- Encouraging Quick Repairs: Pushing you to settle before fully assessing damage.

- Asking Loaded Questions: Trying to get you to admit fault or downplay the damage.

- Claim Denial Threats: Suggesting your claim may be denied without valid reasons.

- Using Contractors They Recommend: These contractors may have agreements with the insurer to save costs.

- Omitting Hidden Damages: Failing to account for damages that aren’t immediately visible.

Dealing with an insurance adjuster after water damage

- Mitigate Damage: Take immediate steps to prevent further damage, such as drying out the area or stopping the water source.

- Provide Evidence: Document all water damage thoroughly with timestamps.

- Highlight Health Risks: Point out potential mold growth or structural issues to emphasize urgency.

- Get Estimates: Obtain repair quotes from independent contractors for comparison.

What home insurance adjusters won’t tell you

- Full Coverage Limits: Adjusters may not inform you about the maximum payout available.

- Hidden Costs: They might overlook incidental costs like temporary housing.

- Supplemental Claims: You can often file additional claims if more damage is discovered later.

- Right to Appeal: Many homeowners are unaware they can challenge a denied claim.

Home insurance claim adjuster secret tactics (California Specific)

- On Reddit: Homeowners share insights like hiring a public adjuster and thoroughly documenting damage.

- In California: Policies often include specific rules about wildfire or earthquake damage. Be aware of unique state protections, like mandatory payouts for certain losses.

Best home insurance claim adjuster secret tactics

- Hire a Public Adjuster: They work on your behalf to maximize payouts.

- Demand Transparency: Request a written explanation for any denial or reduction.

- Use State Resources: File a complaint with your state’s insurance department if needed.

Car insurance claim adjuster secret tactics

- Downplaying Injuries: Suggesting your injuries are minor to reduce medical compensation.

- Quick Settlements: Pushing for fast resolutions to limit future liability.

- Requesting Recorded Statements: Using your words against you later.

- Depreciating Value: Reducing payouts based on the age of your car or parts.

Home insurance payout instead of repair

- Cash Option: You can request a cash payout instead of repairing the damage, but it may be less than the estimated repair cost.

- Policy Details: Check if your policy allows this option and how it affects future coverage.

What happens after the home insurance adjuster comes out?

- Inspection Report: The adjuster submits a damage report to the insurance company.

- Settlement Offer: You’ll receive an initial offer based on their evaluation.

- Negotiation: If the offer is insufficient, you can negotiate or appeal.

How to scare an insurance adjuster

- Knowledge Is Power: Show you fully understand your policy and rights.

- Hire a Lawyer or Public Adjuster: This signals you’re serious about getting fair compensation.

- Mention State Complaints: Indicate willingness to file a complaint with regulatory authorities if treated unfairly.

Does homeowners insurance cover water damage?

- Covered: Burst pipes, appliance leaks, or sudden accidental water damage.

- Not Covered: Gradual issues like mold or damage due to negligence.

Average insurance payout for water damage

- Range: Payouts typically range from $2,500 to $15,000, depending on severity and coverage.

- Factors: Severity of damage, policy limits, and cause of water damage.

How to get insurance to pay for water damage

- Report Immediately: Delays may lead to denial.

- Prove Sudden Damage: Highlight that the issue was accidental and not due to neglect.

- Provide Repair Estimates: Submit third-party assessments for repairs.

10 Tips to Scare Your Insurance Adjuster

- Demand Everything in Writing: Prevents verbal miscommunication.

- Know the Law: Be familiar with insurance regulations.

- Document Thoroughly: Provide undeniable evidence.

- Challenge Low Offers: Present counter-estimates.

- Stay Persistent: Follow up consistently.

- Hire Professionals: Involve contractors and public adjusters.

- Threaten Legal Action: Suggest willingness to escalate.

- Involve Media: If treated unfairly, public attention can pressure insurers.

- File Complaints: Notify state insurance boards.

- Use an Attorney: Signal you’re serious about getting justice.

Conclusion: Home Insurance Claim Adjuster Secret Tactics

Dealing with home insurance claim adjusters can feel overwhelming, but understanding their tactics and preparing yourself with knowledge and strategy can make a significant difference in the outcome of your claim. By documenting everything, staying persistent, and not settling for unfair offers, you’ll be better equipped to navigate the complex world of insurance claims.

If necessary, hiring a public adjuster or lawyer can level the playing field and ensure your rights are protected. At the end of the day, your home insurance is designed to protect you—so be proactive, stay informed, and don’t let an adjuster undermine your claim.

FAQs: Home Insurance Claim Adjuster Secret Tactics

Q1: What is the role of a home insurance claim adjuster?

A1: A home insurance claim adjuster is a professional hired by an insurance company to assess the damage claimed by the policyholder. Their job is to investigate the cause and extent of the loss, review the policy terms, and determine the amount of compensation the homeowner is entitled to. Adjusters are responsible for ensuring that the insurance company pays a fair amount based on the damages, though their primary duty is to protect the insurer’s bottom line.

Q2: Are insurance adjusters trained to minimize claims payouts?

A2: While insurance adjusters are supposed to be impartial and fair, their main goal is to protect the interests of the insurance company, which often involves minimizing the amount paid out. They may use tactics like offering low initial settlements, underestimating the full scope of damages, or delaying the claims process to reduce the overall payout.

Q3: What is a “lowball offer,” and why do adjusters make them?

A3: A lowball offer is an initial settlement offer that is intentionally lower than what the homeowner is entitled to. Insurance adjusters may make this offer to quickly resolve the claim and save the company money. Homeowners should be cautious about accepting the first offer and should carefully review the damages and policy terms before agreeing to a settlement.

Q4: Can an adjuster deny my claim based on policy exclusions?

A4: Yes, insurance adjusters can deny a claim if it falls under an exclusion in the policy, such as damages from flooding or neglect. It’s important to carefully review your policy to understand what is covered and what is excluded. If your claim is denied due to an exclusion, you may have the right to appeal the decision.

Q5: What should I do if the insurance company delays my claim?

A5: If your claim is being delayed, it’s important to follow up regularly with the adjuster and request updates on the status. Document all communications with the insurer and be persistent in asking for a resolution. If delays continue, you may consider contacting a public adjuster or attorney to help expedite the process.

Q6: How can I avoid being taken advantage of by an insurance adjuster?

A6: To avoid being taken advantage of, homeowners should thoroughly document all damages with photos, videos, and written descriptions. Do not accept the first settlement offer without reviewing it carefully. If needed, hire a third-party professional, such as a contractor or public adjuster, to assess the damage and provide an independent evaluation of the repair costs.

Q7: Should I hire a public adjuster?

A7: Hiring a public adjuster can be beneficial if you’re having difficulty negotiating a fair settlement or if your claim is complex. A public adjuster works on behalf of the homeowner, not the insurance company, and can help maximize your payout. They are experts in handling insurance claims and can negotiate with the insurer to ensure a fair resolution.

Q8: How do I know if the insurance adjuster’s assessment is accurate?

A8: To ensure the adjuster’s assessment is accurate, it’s essential to document the damage yourself and compare it with the adjuster’s findings. You can also hire a third-party contractor or professional to provide an independent estimate of the repairs. If you disagree with the adjuster’s assessment, don’t hesitate to challenge it and request a second opinion.

Q9: Can I appeal a denied claim?

A9: Yes, if your home insurance claim is denied, you have the right to appeal the decision. Insurance companies are required to provide a written explanation for the denial, which you can use to assess whether the decision was valid. You can submit additional documentation or seek the assistance of a public adjuster or attorney to help with the appeals process.

Q10: What are the common mistakes homeowners make during the claims process?

A10: Some common mistakes include failing to document damage thoroughly, providing inaccurate or incomplete information to the adjuster, accepting a lowball offer without negotiating, and not following up regularly with the insurer. Homeowners should also avoid making hasty decisions and should take the time to understand their policy’s terms and coverage limits.

Q11: How long does the home insurance claim process take?

A11: The duration of the claims process can vary depending on the complexity of the claim, the amount of damage, and the insurer’s response time. Typically, simple claims can take a few weeks to resolve, while more complicated claims may take several months. Regular follow-ups and keeping communication lines open with your adjuster can help speed up the process.

Q12: Can I get compensation for temporary housing if my home is uninhabitable?

A12: Yes, many home insurance policies include additional living expenses (ALE) coverage, which provides compensation for temporary housing, meals, and other expenses if your home becomes uninhabitable due to a covered event like fire or flood. Review your policy to ensure you have ALE coverage and keep records of all associated expenses.