Insurance Brokers So Rude to Insurers? 4 Bold Reasons Brokers Clash With Insurers

When navigating the insurance industry, one might notice a particular tension in interactions between insurance brokers and insurers. This dynamic, often marked by challenging communications or seemingly “rude” behavior, can leave policyholders and industry professionals alike wondering why these interactions appear so strained. The main focus of this article, “Why Are Insurance Brokers So Rude to Insurers?“, is to explore the reasons why insurance brokers might sometimes seem rude to insurers and to unpack the underlying factors that contribute to this tension. By understanding the roots of this friction, we can better appreciate the roles both brokers and insurers play in ensuring clients receive the coverage they need while maintaining the integrity of the insurance industry.

Insurance brokers act as intermediaries, advocating for clients and working to secure the best possible terms and coverage on their behalf. Insurers, on the other hand, manage and underwrite the policies, balancing risk with profitability. This division of roles can naturally lead to moments of friction, but the reasons go deeper than simple role differences.

In this article, we will dive into the complexities of broker-insurer relationships, covering common issues, industry pressures, and insights into why interactions between brokers and insurers can sometimes seem less than cordial.

Understanding the Roles: Why Insurance Brokers and Insurers Are Often at Odds

To understand the tension, it’s crucial to first look at the roles that insurance brokers and insurers play:

- Brokers: Their role is to represent the client, acting as the client’s advocate. Brokers prioritize customer needs, comparing policies from different insurers to find the most suitable options. They often negotiate with insurers to get clients favorable terms and coverage.

- Insurers: Insurers are responsible for underwriting and pricing the risk associated with each policy. They balance their need to protect clients with the financial and actuarial realities of risk management, which requires evaluating policy terms carefully.

Since brokers are paid through commission by insurers (or, in some cases, fees from clients), they work under pressure to secure the best possible coverage quickly and efficiently, while insurers focus on risk management and profitability.

Key Reasons for Tension Between Insurance Brokers and Insurers

1. Competing Priorities and Pressures

Insurance brokers are driven by customer satisfaction. Their reputation and, often, their pay depend on client retention and successful policy placements. Insurers, however, prioritize minimizing risk exposure and maintaining profitability. These competing priorities lead to differing expectations in interactions:

- Brokers may feel pressured to push insurers for better rates or broader coverage to please their clients.

- Insurers are cautious of risk, making them reluctant to relax terms or lower premiums, especially if a client’s profile presents higher risk.

This push and pull can lead to brokers feeling frustrated by perceived inflexibility, while insurers may see brokers as aggressive or demanding.

2. Communication Barriers and Misaligned Expectations

Communication styles can contribute to friction between brokers and insurers. Brokers, accustomed to advocating on behalf of their clients, may communicate demands forcefully, especially when they feel an insurer is not being responsive to client needs. Insurers, on the other hand, are often constrained by internal processes, regulatory requirements, and underwriting standards, which may make them appear uncooperative or slow in responding to requests.

Misalignment in expectations—where brokers expect quick responses but insurers need time for thorough risk assessment—can amplify this tension. Brokers may interpret delays or hesitation as unwillingness to help, while insurers might see repeated follow-ups as undue pressure.

Also Read: Solar vs Insurance: 3 Powerful Types of Insurance That Cover Solar Panels

3. Differing Interpretations of Policy Language and Terms

One area that frequently causes tension is the interpretation of policy language. Brokers and insurers might have differing views on the scope of coverage, policy exclusions, or terms and conditions.

Disagreements over how policy language applies to a particular claim or coverage issue can become contentious, as each side feels they have the correct interpretation. Brokers tend to push for broader interpretations that benefit clients, while insurers adhere to precise, often restrictive interpretations to control their liability.

For instance, a broker might interpret a clause in a way that favors the client, pushing the insurer to agree to that interpretation. If the insurer pushes back, this can lead to frustration on both sides, creating an impression of rudeness or disrespect.

4. The Impact of Market Conditions and Underwriting Cycles

Insurance market cycles also play a significant role in broker-insurer relations. In a “hard” market, when insurers are less willing to take on risks due to economic factors or increased claims, brokers face greater difficulty securing favorable terms for their clients.

They may feel compelled to adopt a tougher stance with insurers to secure the best possible deals in a more restrictive environment. This pressure often results in more assertive, sometimes confrontational, communication styles.

Conversely, in a “soft” market, brokers have more leverage to negotiate better terms, but even then, they may face pushback if insurers feel brokers are becoming too demanding. Understanding market dynamics is crucial to comprehending why certain conversations between brokers and insurers become heated.

Why Insurance Brokers’ Behavior May Seem “Rude” or Aggressive

1. Client Advocacy and Competitive Pressure

Brokers represent the interests of their clients and often feel an obligation to fight for the best possible outcomes. The competitive nature of the industry means that if one broker cannot secure favorable terms, the client may go to another broker. This pressure to satisfy clients can make brokers more assertive, as they’re motivated to push insurers as hard as possible to avoid losing business.

2. Time Constraints and Response Expectations

In a fast-paced industry, brokers may feel pressured to expedite processes for their clients. For example, if a client urgently needs a policy update or quick claim processing, brokers might become impatient with insurers who do not respond swiftly.

This urgency can make brokers come across as impatient or demanding, leading insurers to perceive their behavior as rude, even when the broker is simply trying to meet the client’s needs.

3. Dealing with Complex Claims and Disputes Cases

Claims handling is a significant source of tension between brokers and insurers. In cases where a claim’s validity is unclear or involves complex details, brokers may be forceful in pushing for client-friendly outcomes.

Insurers, however, follow specific claims protocols and need sufficient documentation to validate claims. Disagreements over claims can escalate quickly, with brokers advocating vigorously for their clients, potentially leading to difficult or even adversarial interactions.

Insurance Brokers So Rude to Insurers: Strategies for Improving Relations Between Brokers and Insurers

Understanding the factors behind broker-insurer tensions can help both sides improve their working relationships. Here are some strategies that can enhance mutual respect and cooperation:

1. Setting Clear Communication Protocols

Implementing structured communication protocols, including timelines for responses and points of contact, can reduce misunderstandings and avoidable frustration. Brokers and insurers who commit to transparent and prompt communication reduce the potential for perceived rudeness.

2. Training for Emotional Intelligence and Conflict Resolution

Both brokers and insurers can benefit from training in emotional intelligence and conflict resolution. This training helps industry professionals manage difficult conversations, focus on solutions rather than obstacles, and work through disagreements respectfully.

3. Regular Collaboration and Feedback

Establishing regular meetings and feedback loops between brokers and insurers fosters trust and cooperation. By actively discussing pain points, both parties can work on creating smoother processes that ultimately benefit clients and reduce unnecessary friction.

4. Clearer Policy Language and Documentation

To avoid disputes over policy terms, brokers and insurers can work together to ensure clients receive clear, understandable policy language. Developing shared resources or guidelines for interpreting common clauses may also help reduce misunderstandings that lead to friction.

Also Read: Insurance Company Suing Me for Damages: 3 Shocking Types

How Brokers and Insurers Can Strengthen Collaboration

Though the competitive and high-stakes nature of the insurance industry creates natural tension, brokers and insurers can take proactive steps to build stronger, more productive relationships. By focusing on collaboration rather than confrontation, both sides can enhance their effectiveness and ultimately improve customer satisfaction.

Here are a few strategies that brokers and insurers can adopt to foster a more cooperative dynamic.

1. Prioritizing Transparent Communication Channels

One of the primary sources of tension between brokers and insurers is a lack of clear, open communication. Brokers often feel frustrated when they don’t receive timely updates from insurers, while insurers may become exasperated when brokers repeatedly ask for quicker responses or special exceptions. Creating standardized communication protocols can help address this issue:

- Dedicated Points of Contact: Both brokers and insurers can establish specific contacts for different policy types or urgent situations, which allows each party to know exactly where to direct questions or requests.

- Clear Response Times: Establishing a mutual understanding of response timelines can also reduce friction. For example, brokers might agree to give insurers 24–48 hours to respond to non-urgent inquiries, while insurers might prioritize more immediate responses in cases involving client claims or renewals.

- Technology Integration: Using technology platforms, such as client relationship management (CRM) software or dedicated insurance communication tools, can streamline exchanges and keep all parties updated on policy statuses, claims progress, or other crucial information in real-time.

2. Shared Training on Policy Interpretation and Industry Standards

Differences in interpreting policy terms are a frequent source of broker-insurer conflict, especially when clients depend on brokers to secure the best possible terms. By creating shared training sessions or collaborative workshops on policy language and industry standards, brokers and insurers can develop a better mutual understanding. This shared knowledge can help:

- Reduce Misunderstandings: Training can lead to more consistent interpretations of key policy clauses and prevent disagreements from arising out of differing assumptions.

- Improve Client Experiences: When brokers and insurers have a unified approach to policy language, it becomes easier to explain complex terms to clients, creating a smoother and more positive customer experience.

3. Aligning on Client Expectations and Long-Term Goals

Brokers and insurers have the same ultimate goal: to provide clients with the best coverage possible while ensuring the financial stability of the policy provider. Regular strategy sessions between brokers and insurers can help each party better understand each other’s priorities, ultimately resulting in improved cooperation:

- Risk Tolerance and Profitability: Brokers who understand an insurer’s risk tolerance and profitability requirements may be more inclined to manage client expectations realistically, avoiding unrealistic promises.

- Policy Customization: Working together to develop flexible policy options allows brokers to better meet unique client needs while allowing insurers to manage risk effectively.

4. Feedback Mechanisms for Continuous Improvement

To maintain an evolving, respectful relationship, brokers and insurers can benefit from feedback mechanisms. Both parties can participate in regular review sessions to discuss what’s working and areas for improvement. Constructive feedback loops can address minor grievances before they grow into larger issues and improve the overall broker-insurer dynamic. For example:

- Performance Metrics: Brokers could give feedback on insurers’ processing times, willingness to accommodate client-specific requests, and communication quality. Conversely, insurers can share feedback on broker requests, suggesting more efficient ways to handle client needs or prioritize requests.

- Client Satisfaction Surveys: Regular surveys can offer insight into clients’ experiences with both brokers and insurers, highlighting areas where both parties could enhance their interactions for better results.

Also Read: Home Insurance Claim Adjuster Secret Tactics: 5 Powerful Secret Tactics

Addressing Misconceptions and Reducing “Rude” Perceptions

Sometimes, the perception that brokers are “rude” to insurers stems from misunderstandings rather than intentional disrespect. Both brokers and insurers can benefit from recognizing these misconceptions and working to reduce any animosity. Here’s how both sides can address these perceptions:

1. Recognizing the Client-Centric Nature of Brokerage

Brokers are often seen as forceful or overly demanding because of their responsibility to prioritize the client. Insurers who understand that brokers’ assertiveness typically stems from a genuine commitment to their clients’ best interests are less likely to take communication as a personal affront.

For their part, brokers can recognize that insurers have constraints they cannot bypass, which are essential to their operations and legal obligations.

2. Valuing Each Other’s Expertise

Insurance brokers are experts in finding tailored coverage options and building client relationships, while insurers are highly knowledgeable about risk assessment and policy design.

By acknowledging the value that each party brings to the table, both sides can foster mutual respect and appreciate that their roles complement each other. This recognition can create a foundation of respect that eases communication and prevents conflicts from escalating.

3. Establishing a “Problem-Solving” Mindset

When brokers and insurers approach each interaction as a problem-solving opportunity, rather than an adversarial exchange, it helps shift the focus away from frustration and toward finding workable solutions. This mindset encourages both parties to identify shared goals and collaborate to overcome obstacles in a constructive manner.

The Future of Broker-Insurer Relationships: Moving Towards Collaboration

The insurance industry is rapidly evolving, and both brokers and insurers must adapt to meet changing client needs, regulatory requirements, and technological advancements. As the industry progresses, a collaborative approach between brokers and insurers will be essential for sustainable success. Here are a few ways in which this partnership could continue to evolve:

1. Leveraging Technology for Enhanced Collaboration

With the growth of digital tools, there are now more opportunities than ever for brokers and insurers to work together seamlessly. Innovations such as digital policy management platforms, AI-driven analytics, and blockchain technology can streamline communications, reduce administrative workloads, and enable real-time information sharing.

As both parties adopt these technologies, the potential for miscommunication and friction decreases, fostering a more collaborative environment.

2. Data-Driven Decision Making

Data analytics allows insurers to better understand risk factors and price policies accurately, while enabling brokers to identify emerging client needs and preferences. By sharing relevant data insights, brokers and insurers can co-develop policies that cater to specific market demands, thereby enhancing both the quality of service and the competitiveness of offerings.

3. Increasing Focus on Customer Experience

The insurance industry’s future is increasingly customer-centric, emphasizing fast, transparent, and accessible service. Brokers and insurers who work together to prioritize customer experience—by streamlining policy offerings, improving claims processes, and providing excellent support—will stand out in the marketplace. A focus on customer experience not only benefits the clients but also strengthens the broker-insurer relationship, as both sides work towards a shared goal.

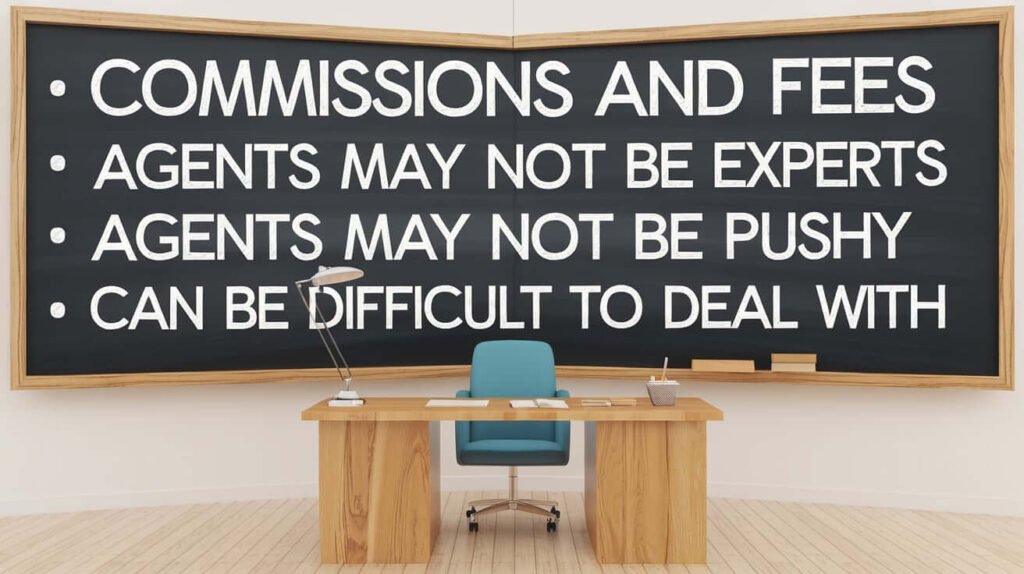

What Are the Negatives of Insurance Brokers?

While insurance brokers offer many benefits, there are also some potential drawbacks to consider:

- Commission-based pay: Brokers typically earn their income through commissions, meaning their recommendations might be influenced by the commissions they receive from specific insurers.

- Conflicts of interest: Some brokers may prioritize policies that offer them higher commissions, potentially leading to biased advice.

- Limited scope: Not all brokers have access to every insurer, so the choices they present may not be as broad as you think.

- Complexity: Insurance brokers can sometimes make the process more complicated, especially for those who are not familiar with insurance terminology.

- Costs: Some brokers may charge fees for their services, which could add extra costs on top of your premium.

Despite these negatives, many people find brokers to be valuable resources when shopping for insurance due to their expertise and personalized service.

Is There an Advantage to Using an Insurance Broker?

Yes, there are several advantages to using an insurance broker:

- Access to multiple insurers: Brokers work with a variety of insurance companies, which gives them access to a wide range of policies. This can help ensure you find the best coverage at the best price.

- Personalized advice: Insurance brokers can assess your individual needs and tailor recommendations accordingly, helping you navigate the complex insurance market.

- Expert knowledge: Brokers are often experts in their field, offering guidance on complicated insurance policies and ensuring you understand the fine print.

- Claims assistance: Many brokers help clients with the claims process, ensuring that they receive the benefits to which they are entitled.

- Time-saving: Instead of spending hours researching insurance options, a broker can handle the shopping for you, saving you time and effort.

Why Do Insurance Carriers Use Brokers?

Insurance carriers often use brokers because:

- Broader market reach: Brokers help insurers tap into a larger pool of potential customers. They can introduce carriers to people who may not otherwise consider their services.

- Cost-effective distribution: By using brokers, insurance companies can avoid the overhead costs of running a large sales team or maintaining direct-to-consumer marketing campaigns.

- Specialized expertise: Brokers often have deep knowledge of specific industries, such as health insurance, car insurance, or life insurance, making them effective at finding customers who need specialized coverage.

Why Do Insurance Brokers Make So Much Money?

Insurance brokers can earn significant amounts of money for several reasons:

- Commission-based pay: Brokers are typically paid a commission based on the insurance policy’s value. For example, they may receive a percentage of the premium paid by the customer for each policy sold.

- High-value policies: Some brokers deal with large commercial insurance policies or high-net-worth individuals, where the premiums are much higher, leading to larger commissions.

- Long-term client relationships: Brokers often cultivate ongoing relationships with clients, earning repeat business and commissions over time.

- Diversification: Many brokers work across multiple types of insurance, such as life, health, auto, and commercial insurance, allowing them to tap into various markets for revenue.

Despite the potentially high earnings, it’s worth noting that brokers may not always earn commission on every sale, and their income can fluctuate based on the volume of clients they service.

Insurance Broker vs. Insurance Agent

Insurance brokers and insurance agents may seem similar, but there are important differences:

- Broker: Works on behalf of the consumer, seeking policies from multiple insurers to find the best coverage at the best price. They are independent and not tied to any one insurance company.

- Agent: Typically works for one insurance company and sells policies offered by that insurer. Agents are limited to the products available from their employer.

Key Differences

- Independence: Brokers are independent and can offer products from multiple insurers, while agents are exclusive to one insurance carrier.

- Client Representation: Brokers work for the client, whereas agents represent the insurance company they work for.

- Scope of Coverage: Brokers usually have access to a broader range of policies and can tailor coverage to specific needs, while agents are limited to the policies their insurer offers.

10 Reasons Why Insurance Agents Fail

There are several reasons why some insurance agents may fail to succeed in their careers:

- Lack of training: Inadequate product knowledge and poor sales skills can hinder success.

- Poor customer service: Failing to build relationships and provide excellent service can result in lost clients.

- Ineffective marketing: Not reaching enough potential clients can lead to a lack of business.

- Inconsistent follow-up: Neglecting to follow up with leads or clients reduces sales potential.

- Limited product knowledge: Without in-depth knowledge of available products, agents may struggle to match clients with the right policies.

- Resistance to change: Not adapting to new technologies or evolving market conditions can limit success.

- Financial mismanagement: Poor financial planning can lead to cash flow problems for an insurance agent running their own business.

- Lack of networking: Building connections is essential in the insurance industry, and neglecting networking can cause stagnation.

- Overpromising: Setting unrealistic expectations can damage credibility and client trust.

- Burnout: The insurance sales industry can be demanding, and burnout can lead to early career failure.

Brokering Insurance

Brokering insurance involves acting as an intermediary between customers and insurance companies. Brokers:

- Search for policies: They help clients find the best insurance policies based on their needs and budget.

- Provide advice: Brokers offer expert advice on choosing policies, understanding coverage options, and explaining insurance terms.

- Assist with claims: Some brokers also help clients file claims and negotiate with insurers to ensure fair payouts.

Insurance Broker for Car Insurance

An insurance broker for car insurance specializes in helping individuals find auto insurance policies that provide the best coverage at competitive rates. They can:

- Compare rates from multiple insurance companies.

- Tailor coverage based on the driver’s needs, such as adding comprehensive, collision, or uninsured motorist coverage.

- Assist with claims: They can guide clients through the claims process and help resolve issues with the insurance company.

Insurance Broker Car

An insurance broker car typically refers to a broker who specializes in auto insurance. These brokers can help clients select the best car insurance based on their driving habits, vehicle type, and coverage requirements.

What Is an Insurance Brokerage?

An insurance brokerage is a firm or business that specializes in selling insurance products from multiple providers. Unlike insurance agents, who work for specific carriers, brokers offer a variety of options to clients. A brokerage often employs a team of brokers who work on behalf of consumers to help them find the most suitable coverage.

Insurance Broker: What Is It?

An insurance broker is a professional who helps individuals and businesses find the most appropriate insurance policies. They:

- Work with various insurance companies.

- Offer expert advice and assistance.

- Help clients understand coverage options, premiums, and terms.

Brokers are typically paid through commissions from insurers for the policies they sell, and they work in the best interest of the client, not the insurance company.

Conclusion: Building Stronger, Respectful Broker-Insurer Relationships

The perceived rudeness that sometimes arises in broker-insurer interactions is often a byproduct of the competitive, high-stakes nature of the insurance industry. Brokers, under pressure to secure favorable terms and meet client expectations, may come across as demanding or confrontational. Insurers, focused on risk management and maintaining profitability, may seem unyielding or slow to respond.

By recognizing each other’s priorities, communicating transparently, and focusing on collaboration, brokers and insurers can significantly improve their working relationships. This cooperative approach benefits not only both parties but also the clients, who ultimately enjoy better, more tailored service. Through shared goals, mutual respect, and a commitment to problem-solving, brokers and insurers can transform their relationship from one of occasional tension to a productive, positive partnership that benefits the entire insurance ecosystem.

As the industry moves forward, fostering a collaborative broker-insurer relationship will become increasingly essential for success. By embracing technological advancements, refining communication strategies, and prioritizing customer needs, brokers and insurers have the opportunity to reshape their interactions and create an environment of mutual respect and efficiency.

FAQs on Why Insurance Brokers May Appear Rude to Insurers

Why do insurance brokers sometimes seem rude to insurers?

Brokers may come across as rude because they are under pressure to secure favorable terms for their clients. This pressure can make them more assertive or demanding in negotiations with insurers, especially if they believe an insurer is not meeting client needs or responding quickly enough. Additionally, brokers act as client advocates, which can lead to more aggressive communication as they push for the best possible outcomes.

Do insurance brokers intentionally act confrontational with insurers?

Not usually. While some interactions may seem confrontational, most brokers aren’t intentionally trying to be difficult. The confrontational behavior often stems from their responsibility to prioritize their clients’ best interests, which can sometimes lead to forceful communication. Brokers aim to secure favorable terms for their clients and may feel they need to press insurers to achieve these goals.

Why is there tension between insurance brokers and insurers in the first place?

Tension often arises because brokers and insurers have different primary goals. Brokers are focused on obtaining the best coverage and rates for their clients, while insurers are focused on managing risks and profitability. This natural divide in priorities can lead to disagreements, especially when brokers push for terms or concessions that insurers feel might expose them to higher risks.

What are some common sources of conflict between brokers and insurers?

Common sources of conflict include differences in interpreting policy terms, delays in communication or responses, disagreements over claims, and the impact of market conditions. For instance, in a “hard” market, when insurers are more conservative about underwriting policies, brokers may feel that insurers are unreasonably strict, leading to friction.

How can brokers and insurers improve their working relationship?

Brokers and insurers can improve their relationship by establishing clear communication protocols, setting realistic expectations, and engaging in regular feedback sessions. Investing in collaborative training sessions on policy interpretation and using technology to streamline communication can also foster a better understanding between the two parties. Emphasizing transparency and mutual respect is key.

Is it true that brokers prioritize client satisfaction over insurer relationships?

Yes, brokers generally prioritize client satisfaction because their business depends on retaining clients and meeting their needs. While maintaining a good relationship with insurers is important, brokers’ primary duty is to advocate for their clients. This focus sometimes means they’ll push insurers harder than they might if they were only concerned with the insurer relationship.

What role does market condition play in broker-insurer interactions?

Market conditions, such as “hard” or “soft” markets, significantly impact broker-insurer dynamics. In a hard market, where insurers tighten underwriting standards, brokers may face more difficulty securing favorable terms, leading to increased tension as they advocate for their clients. In a soft market, insurers are more flexible, and brokers find it easier to negotiate, leading to less friction.

Can technology help reduce friction between brokers and insurers?

Absolutely. Technologies such as digital communication platforms, real-time data sharing, and policy management tools can help streamline processes, improve response times, and reduce misunderstandings. By having clearer, more accessible communication channels, both brokers and insurers can work more efficiently, reducing potential conflicts.

How do insurers perceive assertive or demanding brokers?

Insurers may perceive assertive brokers as overly aggressive or even unprofessional, particularly if they repeatedly push for exceptions or faster responses. However, understanding that brokers are advocating for their clients can help insurers see these interactions as part of the broker’s role rather than personal disrespect.

Is the broker-insurer tension bad for clients?

Not necessarily. While tension can create friction, it can also ensure that brokers are actively advocating for the best client outcomes. Healthy tension, when managed respectfully, can lead to better deals, policy terms, and customer satisfaction as both brokers and insurers strive to provide quality service.

What are some long-term solutions to reduce conflicts between brokers and insurers?

Long-term solutions include establishing mutual goals, such as focusing on customer satisfaction, using technology to improve communication, providing joint training on industry standards, and creating feedback loops. By prioritizing transparency and understanding each other’s roles, brokers and insurers can reduce conflicts and create a more positive working environment.

Are there benefits to a good broker-insurer relationship for clients?

Yes, a strong, cooperative broker-insurer relationship benefits clients by enabling smoother policy placements, faster claim resolutions, and potentially better policy terms. When brokers and insurers work well together, it enhances the client experience, leading to higher satisfaction and trust in both the broker and the insurer.