Is Airbnb Travel Insurance Worth It? 5 Powerful Pros & Cons

Traveling can be one of the most exciting and enriching experiences, but it also comes with a certain level of risk. From flight delays to medical emergencies or property damage, unexpected events can quickly derail even the most well-planned trips. This is where travel insurance comes in, offering peace of mind in the face of the unknown. One travel insurance option gaining popularity is Airbnb’s own travel insurance. But the burning question is: Is Airbnb travel insurance worth it?

In this article, we’ll explore what Airbnb travel insurance covers, its benefits, potential drawbacks, and help you decide if it’s the right option for your next adventure.

Table of Contents

- What Is Airbnb Travel Insurance?

- Different Types of Airbnb Travel Insurance

- What Does Airbnb Travel Insurance Cover?

- Is Airbnb Travel Insurance Worth It?

- Also Read: Can a Doctor Look Up Insurance Without a Card

- Alternatives to Airbnb Travel Insurance

- When Should You Consider Airbnb Travel Insurance?

- Is Airbnb Cancellation Covered by Travel Insurance?

- What Does Airbnb Insurance Not Cover?

- What Is the Average Cost of Airbnb Insurance?

- Airbnb Travel Insurance: Is It Worth It?

- Airbnb Travel Insurance After Booking

- Conclusion: Is Airbnb Travel Insurance Worth It?

- FAQs

What Is Airbnb Travel Insurance?

Airbnb’s travel insurance is a specialized form of coverage designed to protect travelers who book stays through the platform. Airbnb partners with various insurers to offer this coverage, which is aimed at addressing issues like trip cancellations, medical emergencies, or property damage during your stay. The travel insurance options provided by Airbnb can give you the confidence to book accommodations, knowing that you’re financially covered if something goes wrong.

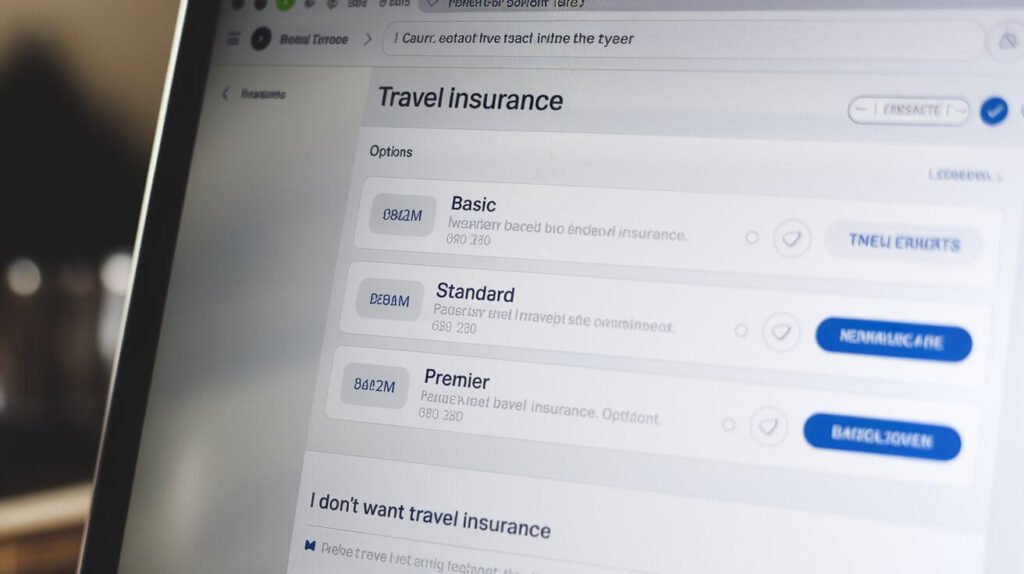

Different Types of Airbnb Travel Insurance

Before diving into whether Airbnb travel insurance is worth it, it’s essential to understand the types of coverage it offers. These policies vary based on the region and specific booking requirements, but in general, they fall into two main categories:

- Trip Cancellation and Interruption Insurance: This covers the cost of your booking if you have to cancel your trip for specific reasons, such as illness, injury, or a family emergency.

- Property Damage Protection: This provides coverage in case you accidentally damage the property you’re staying in. Some hosts may require this coverage as part of their booking terms.

What Does Airbnb Travel Insurance Cover?

Airbnb travel insurance aims to cover several scenarios that could disrupt your trip or result in financial loss. However, the specifics can vary depending on the policy and location, so always check the details before purchasing. Below are some common features of Airbnb’s travel insurance.

1. Trip Cancellation and Interruption

Life happens. Whether you’re struck by an illness, a family emergency arises, or a flight gets delayed, Airbnb’s insurance can help cover the costs if you have to cancel or cut your trip short. You may be eligible for a refund on non-refundable payments, such as accommodation fees, which could save you hundreds of dollars.

2. Travel Delay Coverage

Airlines aren’t always on time, and when delays occur, you can be left with unexpected costs. Airbnb travel insurance can reimburse you for reasonable expenses incurred during travel delays, such as food, lodging, and transportation, helping to ease the burden.

3. Medical Emergencies and Evacuations

If you experience a medical emergency while traveling, Airbnb’s travel insurance may cover the cost of medical treatment, including emergency medical evacuations. This is particularly helpful for travelers heading to areas where access to quality healthcare may be limited.

4. Damage to Property

Accidental damage can happen, and Airbnb’s travel insurance offers coverage if you unintentionally damage your rental property. This could include broken furniture, damage to walls, or spills on carpets. Having this protection in place ensures you won’t face an unexpected out-of-pocket expense.

5. Lost Luggage and Personal Items

If your luggage is delayed or lost, Airbnb travel insurance can provide compensation for your lost belongings, which is especially valuable if you’re traveling with valuable or essential items.

Is Airbnb Travel Insurance Worth It?

Now that we have a solid understanding of what Airbnb travel insurance covers, it’s time to address the key question: Is it worth it? To determine this, we’ll look at the pros and cons, compare it to other travel insurance options, and assess whether the price justifies the benefits.

Pros of Airbnb Travel Insurance

- Convenience Purchasing Airbnb travel insurance is incredibly convenient. It’s often offered during the checkout process, and you can add it to your booking with just a few clicks. This saves you the trouble of researching and purchasing separate travel insurance.

- Coverage for Property Damage Airbnb’s coverage includes property damage protection, which can be a huge benefit. If you accidentally damage the property you’re renting, this insurance can prevent costly repairs from coming out of your pocket.

- Tailored for Airbnb Bookings Since the insurance is specifically designed for Airbnb stays, it takes into account the unique nature of short-term rentals. This means the coverage is more likely to meet your needs than a standard travel insurance policy.

- Affordable Airbnb travel insurance is generally affordable, especially when compared to traditional travel insurance policies. Depending on your booking and destination, it may cost just a few extra dollars for peace of mind.

- Covers a Range of Scenarios From trip cancellations to medical emergencies and property damage, Airbnb travel insurance covers a broad range of scenarios. This comprehensive coverage can provide valuable protection for travelers, especially those who are booking accommodations in unfamiliar locations.

Cons of Airbnb Travel Insurance

- Limited Coverage While Airbnb travel insurance does cover a wide range of scenarios, it may not cover everything. For example, it may have exclusions related to pre-existing medical conditions, certain natural disasters, or non-refundable fees that are not part of your stay. Always read the policy terms carefully to understand what is and isn’t covered.

- Not Always the Best Value While Airbnb travel insurance is affordable, it may not offer the best value compared to other travel insurance providers. Some traditional insurers may offer more comprehensive policies, including coverage for things like trip interruption, lost baggage, and emergency medical treatment.

- Requires Extra Research Though Airbnb offers travel insurance during booking, not all properties participate in the program. You’ll need to check whether the host accepts Airbnb’s insurance, and you may have to purchase third-party insurance if they don’t.

- No Coverage for Certain Activities Airbnb’s travel insurance may not cover injuries or incidents that occur during certain high-risk activities, such as extreme sports or dangerous outdoor adventures. If you’re planning to engage in these activities during your trip, you might need to seek out additional coverage.

Also Read: Can a Doctor Look Up Insurance Without a Card

Alternatives to Airbnb Travel Insurance

If you’re on the fence about whether Airbnb’s travel insurance is worth it, you might consider other options available in the market. Here are some alternatives to keep in mind:

1. Traditional Travel Insurance

Traditional travel insurance policies often provide broader coverage, including trip interruption, lost luggage, medical treatment, and more. While it’s more expensive, it might offer better protection for travelers seeking more comprehensive coverage.

2. Credit Card Travel Insurance

Some credit cards offer travel insurance as a perk for cardholders. If you have a credit card with travel insurance benefits, check to see if it covers Airbnb stays, trip cancellations, and other travel-related incidents. This could be an excellent way to save money while still being protected.

3. Third-Party Insurance Providers

There are a variety of third-party insurance providers that offer coverage tailored to specific needs. These policies can be customized to provide more comprehensive or specialized coverage, such as adventure sports or international medical evacuations.

When Should You Consider Airbnb Travel Insurance?

Airbnb travel insurance can be worth it for specific types of trips or travelers. If you’re booking a short stay and want basic coverage for trip cancellation, property damage, or travel delays, this insurance could be a perfect fit. However, if you’re embarking on a longer journey or need more comprehensive coverage, you may want to explore traditional travel insurance options.

Is Airbnb Cancellation Covered by Travel Insurance?

It depends on the travel insurance policy. Some travel insurance plans cover cancellations if:

- You cancel due to a covered reason (e.g., illness, family emergency, or natural disasters).

- You purchased a “Cancel for Any Reason” (CFAR) add-on, which provides partial reimbursement for cancellations regardless of the reason.

It’s essential to check your policy’s terms to confirm whether Airbnb stays are included in the coverage.

Do I Need Extra Insurance for Airbnb?

It depends on your role:

- As a Guest: You may not need extra insurance beyond travel insurance. However, travel insurance can help cover cancellations, trip interruptions, or personal belongings.

- As a Host: Airbnb offers AirCover, which provides liability insurance and damage protection, but this may not cover everything. Many hosts purchase supplemental insurance to cover gaps (e.g., lost income due to property damage or extended liability).

What Does Airbnb Insurance Not Cover?

Airbnb’s AirCover insurance, included for both hosts and guests, has certain exclusions:

- For Guests: It does not cover trip cancellations unless the cancellation is due to the host or specific outlined issues.

- For Hosts: AirCover does not cover:

- Wear and tear of property.

- High-value items beyond the set limits.

- Business interruption or lost income during repairs.

- Liability claims related to intentional acts or illegal activities are also excluded.

What Is the Average Cost of Airbnb Insurance?

- Guest Insurance (Travel Insurance): Costs range from 4%-10% of the total trip cost, depending on the policy and coverage.

- Host Insurance: Standalone Airbnb-specific policies for hosts range from $350 to $1,000 annually, depending on property type, location, and coverage limits.

Travel Insurance and Airbnb

Travel insurance often applies to Airbnb bookings if:

- The policy includes coverage for accommodations.

- The cancellation or interruption is due to a covered event (e.g., illness or weather-related disruptions). Always verify if your insurer explicitly covers short-term rental stays like Airbnb.

Airbnb Travel Insurance: Is It Worth It?

Airbnb’s travel insurance (via Generali) can be worth it if you want added protection against:

- Cancellations due to illness or emergencies.

- Lost or delayed baggage.

- Trip interruptions. However, compare it with third-party travel insurance to ensure the coverage and price meet your needs.

Airbnb Trip Insurance

Airbnb partners with Generali Global Assistance to offer trip insurance. Coverage includes:

- Reimbursement for trip cancellations or interruptions.

- Emergency medical expenses.

- Baggage loss or delays. This insurance is available during the booking process or through your Airbnb account.

Airbnb Travel Insurance: Illness

Generali’s Airbnb travel insurance covers trip cancellations or interruptions due to illness if:

- The illness is unforeseen.

- It prevents you from traveling or continuing your trip.

- You provide proper documentation, such as a doctor’s note.

Airbnb Travel Insurance Reviews

Reviews of Airbnb travel insurance (Generali) are mixed:

- Positive: Convenient to purchase, straightforward claims process, and affordable for basic coverage.

- Negative: Limited coverage compared to third-party travel insurance, and some users report delays in claims processing.

Airbnb Travel Insurance After Booking

You can purchase Airbnb’s travel insurance after booking but only before your trip begins. Some third-party travel insurers also allow post-booking purchases, though this often excludes pre-existing conditions or other retroactive events.

Airbnb Travel Insurance Generali

Generali Global Assistance is Airbnb’s official travel insurance provider. Policies cover:

- Trip cancellation or interruption.

- Medical expenses during the trip.

- Lost or delayed baggage. Generali is a trusted name in travel insurance but may not be as comprehensive as standalone providers.

Airbnb Travel Insurance Cancellation

Generali’s travel insurance covers cancellations for:

- Illness or injury of the insured or a family member.

- Natural disasters affecting the destination.

- Other covered emergencies listed in the policy. If the cancellation is not covered, Cancel for Any Reason (CFAR) policies from third-party providers may be a better option.

Airbnb Travel Insurance Refund

Refunds depend on:

- Whether your cancellation reason is covered.

- Providing necessary documentation for claims (e.g., medical certificates or travel delay proof). Typically, you’ll be reimbursed within a few weeks after submitting a claim, provided it meets policy terms.

Conclusion: Is Airbnb Travel Insurance Worth It?

So, is Airbnb travel insurance worth it? The answer depends on your personal needs and the type of trip you’re taking. For short-term stays, particularly if you’re booking a single accommodation through Airbnb, the insurance is a great option for basic coverage. It’s affordable, convenient, and tailored for Airbnb travelers. However, if you’re looking for more extensive protection or plan on engaging in high-risk activities, you may want to explore other travel insurance providers. Always read the fine print and compare your options before making a decision.

FAQs

Does Airbnb travel insurance cover medical emergencies?

Yes, Airbnb travel insurance includes coverage for medical emergencies, including emergency medical evacuations.

Is Airbnb travel insurance refundable?

Refunds for Airbnb travel insurance depend on the specific terms of your policy. Generally, if you cancel the trip within the allowed time frame, you may be eligible for a refund.

Can I use Airbnb travel insurance for international trips?

Yes, Airbnb travel insurance can be used for international trips, though the exact coverage may vary depending on the country.

What’s the cost of Airbnb travel insurance?

The cost of Airbnb travel insurance varies based on factors like your booking’s total price, the destination, and the type of coverage. It is usually affordable and added during checkout.

Can I use other travel insurance if I book through Airbnb?

Yes, you can use other travel insurance options even if you book through Airbnb, but make sure it covers Airbnb stays and the specific risks of your trip.