Do You Need a Motorcycle License to Finance a Motorcycle? 3 Powerful Factors Smart Lenders Consider

Buying a motorcycle is a thrilling experience, but if you’re looking to finance it, you might wonder if having a motorcycle license is required. Understanding this requirement can help you avoid surprises, so let’s dive into the essentials of motorcycle financing and what you need to know about license requirements.

Table of Contents

- Understanding Motorcycle Financing

- Do You Need a Motorcycle License to Finance a Motorcycle?

- 3 Factors Lenders Consider for Motorcycle Financing

- Also Read: Do You Need a Do You Need Full Coverage on a Used Financed Car?

- Financing Without a Motorcycle License: Possible?

- Pros and Cons of Financing a Motorcycle Without a License

- Tips for Financing a Motorcycle Successfully

- Other Requirements Beyond Licensing

- How to Choose the Right Lender for Motorcycle Financing

- Is It Harder to Finance a Motorcycle Without a License?

- How Does Financing Work for a Motorcycle?

- Can You Register a Motorcycle Without a License in California?

- How to Get Your Motorcycle Permit in California

- Can You Get a Motorcycle Loan Without a License?

- Buying a Motorcycle with a Learner’s Permit

- Should You Wait to Buy a Motorcycle?

- Do You Need a Motorcycle License to Buy a Motorcycle in California?

- Do You Need a Motorcycle License to Buy a Motorcycle from a Dealership?

- Do You Need a Motorcycle License to Get Insurance?

- Do You Need a Motorcycle License to Finance a Motorcycle Near You?

- Can I Buy a Motorcycle with a Permit?

- Can I Buy a Motorcycle Without a Motorcycle License?

- How Long Can You Register a Motorcycle Without a License?

- If I Buy a Motorcycle, Can I Drive It Home Without a License?

- Alternatives to Traditional Financing

- Steps to Take After Financing Approval

- Conclusion

Understanding Motorcycle Financing

What Does Financing a Motorcycle Mean?

When you finance a motorcycle, you’re essentially borrowing money to pay for it. Instead of paying the full amount upfront, financing allows you to make monthly payments over a set term. This way, owning a bike becomes more accessible without straining your budget.

4 Common Terms in Motorcycle Financing

In motorcycle financing, you’ll encounter following terms;

- APR (Annual Percentage Rate)

- Loan term

- Principal

- Down payment.

Understanding these basics will help you make an informed decision on financing offers.

How Financing Differs from Other Payment Options

Unlike cash purchases or leases, financing lets you build equity in the bike, meaning you’ll own it once the loan is paid off. This can be advantageous if you want to upgrade later on or sell it for some value back.

Do You Need a Motorcycle License to Finance a Motorcycle?

Basic Requirements for Financing

To qualify for motorcycle financing, lenders typically look at your financial profile, including your credit score, income, and sometimes proof of stable employment. But do you actually need a motorcycle license? The short answer is: it depends on the lender.

License Requirements by Lender

Some lenders may require a valid motorcycle license, especially for higher loan amounts, while others might be flexible. Often, lenders prioritize your ability to make payments over whether you’re licensed, but it’s best to check with each lender.

Role of State Laws in Motorcycle Financing

State laws don’t typically require a motorcycle license for financing, as financing terms are generally governed by the lender’s policy rather than state regulations.

3 Factors Lenders Consider for Motorcycle Financing

- Credit Score and Financial History

Your credit score is a major factor. A higher score signals to lenders that you’re reliable with payments, making them more likely to approve your application. Aim for a score above 650 for better loan terms.

- Importance of Income and Employment Status

Steady income and employment history also play a role, as lenders want assurance that you can make your monthly payments. If you have a co-signer, their income and credit can also impact approval.

Also Read: Do You Need a Do You Need Full Coverage on a Used Financed Car?

- Down Payments and Collateral Considerations

A larger down payment can improve your chances of approval and even lower your interest rate. Some lenders may view the bike itself as collateral, making it essential to stay on top of payments.

Financing Without a Motorcycle License: Possible?

- Scenarios Where You May Not Need a License

In some cases, a license isn’t necessary, especially if you’re in the process of getting one. Many dealerships and lenders understand that new riders might finance a bike before completing their licensing.

- Cases for New Riders or Learner’s Permits

If you have a learner’s permit, some lenders may allow you to finance under that status. It’s helpful to explain your intention to get a full license if asked.

- Financing for Future Licensing Plans

If you plan to obtain your license soon, let your lender know. Financing with the intention of future licensing can sometimes be enough to proceed.

Pros and Cons of Financing a Motorcycle Without a License

- Advantages of Early Financing

One benefit of financing without a license is that you can secure your dream bike early, especially if there’s a great deal or limited availability.

- Potential for Better Deals and Lower Rates

When you finance early, you might lock in lower interest rates or take advantage of seasonal sales, which can save you money in the long run.

- Disadvantages and Risks

Financing without a license does have its risks. You may face higher insurance costs or stricter lender requirements to compensate for your lack of licensing.

- Possibility of Higher Insurance Costs

Without a license, insurers might see you as a higher risk, potentially leading to higher premiums or fewer policy options.

Tips for Financing a Motorcycle Successfully

- Steps to Improve Your Approval Odds

To increase your chances of financing approval, build your credit, save for a larger down payment, and be ready to show proof of stable income.

- Build a Strong Credit Profile

Paying bills on time and keeping credit balances low will help improve your credit score, making you a more attractive candidate for financing.

- Tips for Providing Proof of Stable Income

Prepare to show recent pay stubs, bank statements, or tax returns to give lenders confidence in your financial stability.

Other Requirements Beyond Licensing

- Importance of Motorcycle Insurance

Most lenders require you to have insurance before you can take the bike off the lot. Motorcycle insurance is crucial for protecting both you and the lender’s investment.

- Types of Motorcycle Insurance

Standard insurance includes liability, collision, and comprehensive coverage. Adding more coverage can protect you against a wider range of potential issues.

- Impact of Licensing on Insurance Rates

A valid motorcycle license may lead to lower insurance rates, as it indicates you’re qualified to handle the bike safely.

How to Choose the Right Lender for Motorcycle Financing

Types of Lenders: Banks vs. Dealerships

Banks, credit unions, and dealerships all offer motorcycle loans, but terms vary. Dealerships often have promotions or special financing offers, while banks may offer more flexibility with rates.

Benefits of Specialized Motorcycle Lenders

Some lenders focus on motorcycle financing specifically, which can be beneficial if you’re new to biking or have unique financing needs.

Comparing Interest Rates and Terms

Shop around for competitive rates and flexible terms. Don’t settle for the first offer, as a slightly lower rate can save you a lot in interest.

Is It Harder to Finance a Motorcycle Without a License?

While it is possible to finance a motorcycle without a license, it may be a bit more challenging compared to financing with one. Lenders typically require proof of identity and the ability to operate the motorcycle as part of the application process. Without a motorcycle license, they may see you as a higher risk.

However, there are ways to get financing even without a license:

- Co-Signer: Having a co-signer with a valid license and good credit can improve your chances.

- High Credit Score: If you have a strong credit history, lenders may be more willing to finance the purchase.

In short, while financing a motorcycle without a license isn’t impossible, it may come with stricter conditions or higher interest rates.

How Does Financing Work for a Motorcycle?

When financing a motorcycle, you’re essentially borrowing money from a lender (usually a bank, credit union, or dealership) to purchase the bike. Here’s how the process typically works:

- Loan Application: You’ll fill out an application form, providing personal information, employment details, and your credit history.

- Approval Process: The lender will assess your financial situation and credit score to determine if you qualify for financing. They’ll also look at the motorcycle’s value to make sure it’s collateral for the loan.

- Loan Terms: If approved, you’ll receive loan terms, which include the interest rate, loan amount, and repayment period.

- Down Payment: You’ll likely need to make a down payment upfront, which can range from 10-20% of the total price.

- Monthly Payments: Once you agree to the terms, you’ll make regular payments to pay off the loan.

Without a license, you may need to demonstrate the ability to repay the loan, possibly requiring additional documentation or a co-signer.

Can You Register a Motorcycle Without a License in California?

Yes, you can register a motorcycle in California without a license. The California Department of Motor Vehicles (DMV) does not require a motorcycle license to register a motorcycle, but you will need to fulfill other requirements:

- Proof of ownership (bill of sale or title)

- Proof of insurance

- Payment for registration fees

- A completed Application for Title or Registration (Form REG 343)

While you don’t need a motorcycle license to register the bike, keep in mind that you can’t legally ride it until you have the proper permit or license.

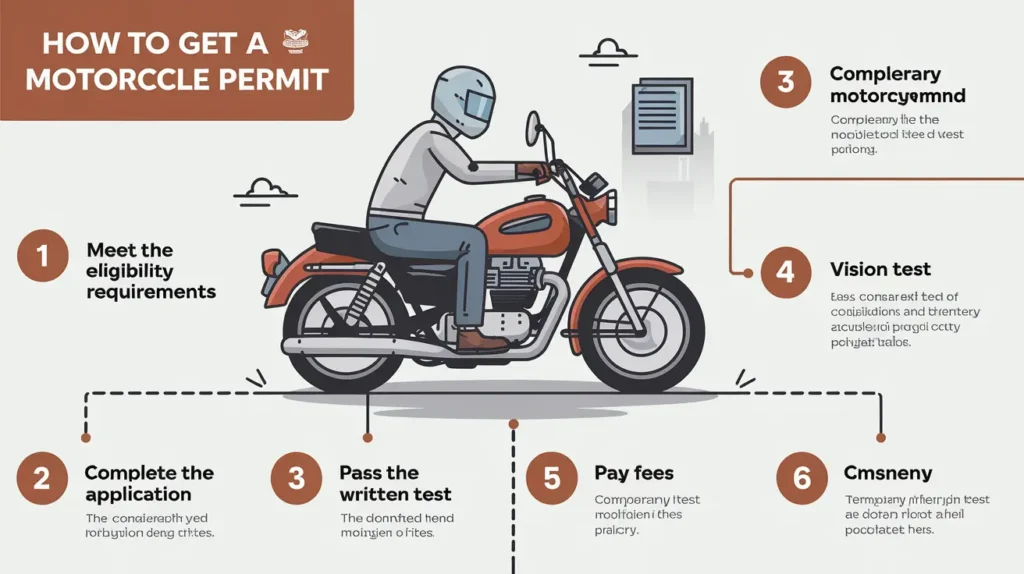

How to Get Your Motorcycle Permit in California

In California, you must get a motorcycle permit before you can apply for a full motorcycle license. Here’s how to get your permit:

- Meet the Eligibility Requirements: You need to be at least 15 ½ years old.

- Complete the Application: Visit your local DMV and complete the motorcycle permit application.

- Pass the Written Test: You’ll need to pass a written knowledge test on traffic laws, road signs, and motorcycle operation.

- Vision Test: A basic vision screening is required.

- Pay Fees: There’s a fee for the permit application, which can vary by location.

- Temporary Motorcycle Permit: Once you pass, you’ll receive a motorcycle learner’s permit, which allows you to ride with certain restrictions, like not riding at night or carrying passengers.

Buying a Motorcycle Without a License

You can purchase a motorcycle without having a license, but there are some important things to consider:

- Dealerships and Private Sellers: Dealers typically don’t require a license to purchase, though they may ask for identification and proof of insurance. Private sellers might not ask for a license either, but the purchase process might be more informal.

- Test Ride: Without a motorcycle license, you won’t be allowed to take a test ride unless you’re accompanied by someone with a valid license or you have a learner’s permit.

- Insurance: Most insurance companies will require a valid license to provide coverage. If you don’t have one, you may face higher rates or difficulties obtaining a policy.

Can You Get a Motorcycle Loan Without a License?

Yes, you can get a motorcycle loan without a license, but as mentioned earlier, lenders might impose stricter requirements. You may need:

- A co-signer with a valid license

- Proof of insurance (which could be difficult to obtain without a license)

- A good credit score to prove your ability to repay the loan

Financing may also come with a higher interest rate since lenders perceive the lack of a license as a higher risk.

Buying a Motorcycle with a Learner’s Permit

Yes, you can buy a motorcycle with a learner’s permit in California. A learner’s permit allows you to legally operate a motorcycle under certain restrictions, such as no riding after dark and no passengers. However, having a learner’s permit could still help when financing or registering your bike.

Registering a Motorcycle Without a License

In California, as mentioned earlier, you do not need a motorcycle license to register a motorcycle. The DMV will only require proof of ownership, proof of insurance, and payment for registration fees. However, you’ll need a valid driver’s license, not necessarily a motorcycle-specific one, to complete the registration process.

Should You Wait to Buy a Motorcycle?

If you don’t have a motorcycle license, it’s generally advisable to wait until you’ve obtained a permit or license, especially if you plan to ride immediately. Buying a motorcycle without a license can limit your ability to use it legally and can lead to complications with insurance and financing.

Do You Need a Motorcycle License to Buy a Motorcycle in California?

No, you do not need a motorcycle license to buy a motorcycle in California. The purchase process is separate from licensing and can be completed without the need for a motorcycle-specific license. However, you will need to have a valid ID (such as a driver’s license) and proof of insurance to complete the purchase.

Do You Need a Motorcycle License to Buy a Motorcycle from a Dealership?

No, you do not need a motorcycle license to buy a motorcycle from a dealership. However, you will need a valid ID and proof of insurance to complete the transaction. A motorcycle license is only necessary if you plan to operate the bike immediately after purchase.

Do You Need a Motorcycle License to Get Insurance?

Yes, most insurance providers will require that you have a valid motorcycle license to insure a bike. If you don’t have a motorcycle license, you may be able to obtain insurance under certain conditions, but it will likely be more expensive, and there might be additional restrictions placed on your policy.

Do You Need a Motorcycle License to Finance a Motorcycle Near You?

No, you do not need a motorcycle license to finance a motorcycle. However, lenders may look at your ability to operate the bike when making their decision. If you don’t have a license, you may need to provide additional documentation, a co-signer, or a larger down payment to secure financing.

Can I Buy a Motorcycle with a Permit?

Yes, you can buy a motorcycle with a learner’s permit. While you will not be able to ride the bike until you obtain your full motorcycle license, the permit allows you to operate the bike under certain restrictions, such as no night riding or carrying passengers.

Can I Buy a Motorcycle Without a Motorcycle License?

Yes, you can buy a motorcycle without a motorcycle license, but there may be additional challenges regarding insurance, financing, and registration. While you can legally own a motorcycle, you cannot legally ride it until you have the proper license or permit.

How Long Can You Register a Motorcycle Without a License?

You can register a motorcycle without a motorcycle license in California, but you cannot legally operate it without a valid driver’s license or a motorcycle permit. The registration process itself doesn’t require a motorcycle license, but operating the motorcycle on public roads will.

If I Buy a Motorcycle, Can I Drive It Home Without a License?

No, you cannot legally ride a motorcycle home without a valid motorcycle license or permit. In California, if you buy a motorcycle without a license, you must either have someone with a valid license ride it for you or transport it another way (e.g., via a truck or trailer).

Alternatives to Traditional Financing

Lease Options for Motorcycles

If you’re not ready to commit to ownership, leasing can be a great alternative. Leasing allows for lower monthly payments and more flexibility.

How Leasing Differs from Financing

With leasing, you’re essentially renting the motorcycle for a set term instead of buying it outright. At the end of the lease, you have the option to purchase the bike or return it, making it an attractive option if you’re not yet ready to commit to long-term ownership.

Pros and Cons of Leasing

Leasing offers flexibility with typically lower monthly payments, but you won’t build ownership equity in the bike. It’s ideal if you want to upgrade frequently but may be less cost-effective if you plan to ride the bike long-term.

Steps to Take After Financing Approval

Preparing for the Motorcycle Purchase

Once your financing is approved, you’re ready to complete the purchase process. Confirm the terms, including your monthly payment amount, due dates, and any penalties for late payments to avoid surprises.

Completing Licensing Requirements

If you don’t already have your motorcycle license, now is the time to pursue it. Completing a motorcycle safety course can often reduce licensing requirements and may even lower your insurance premium.

Scheduling Motorcycle Insurance

With financing in place, you’ll need to secure motorcycle insurance to meet lender requirements. Compare insurance providers to get the best rate for your needs, taking advantage of discounts for safety courses or bundled policies.

Conclusion

Financing a motorcycle without a license is indeed possible, but it varies depending on the lender’s policies and your personal circumstances. While some lenders are flexible and allow financing without a license, having one can simplify the process and potentially save you on insurance costs. Financing early can be beneficial, allowing you to secure a great deal and lock in low rates, especially if you’re committed to obtaining a license soon.

Ultimately, understanding the requirements and potential obstacles can help you make informed choices as you navigate motorcycle financing. Whether you’re an experienced rider or just starting your journey, exploring all your options will bring you closer to your dream bike with confidence and clarity.

FAQs

Do I need a license to buy a motorcycle?

No, you can usually buy a motorcycle without a license. However, you’ll need a license to legally ride it on public roads, and some dealerships may require a license for test rides.

Can I test ride a motorcycle without a license?

Most dealerships require a valid motorcycle license for test rides to ensure safety. Without a license, you may need to rely on dealer reviews and visual inspections.

What credit score do I need to finance a motorcycle?

A credit score of 650 or higher is generally recommended for favorable financing terms. However, some lenders work with scores below this, though you may face higher interest rates.

How does a co-signer help with motorcycle financing?

A co-signer with a strong credit profile can improve your chances of approval and may even lead to better interest rates, as they share responsibility for the loan.

5. Can I get insurance without a motorcycle license?

Yes, but it may be more expensive. Insurers may view unlicensed riders as higher risks, so securing a license often results in better insurance rates.