Solar vs Insurance: 3 Powerful Types of Insurance That Cover Solar Panels

As solar energy becomes more popular, the conversation around “solar vs insurance” is gaining traction. Solar panels are a significant investment, and just like any major asset, they need protection. But how do solar panels and insurance interact? Do they increase your premiums? Are they covered under standard policies?

This article dives deep into everything you need to know about solar panels and insurance, helping you make informed decisions for your home or business.

Table of Contents

- What Are Solar Panels?

- Why Solar Panels Need Insurance Coverage

- Solar vs Insurance: Types of Insurance That Cover Solar Panels

- Solar vs Insurance: How Homeowners Insurance Covers Solar Panels

- Also Read: Insurance Company Suing Me for Damages: 3 Shocking Types

- Do You Need Separate Solar Insurance?

- Solar vs Insurance: Factors That Affect Solar Insurance Premiums

- Weather Risks: Solar Panels and Insurance Claims

- Roof vs Ground-Mounted Solar Panels and Insurance

- Cost Implications: Solar Panels vs Insurance Premiums

- Do Solar Panels Increase Home Value?

- What If You Lease Solar Panels?

- Solar vs Insurance: Choosing the Right Insurance for Solar Panels

- Solar Incentives and Their Effect on Insurance

- Future Trends: Solar Energy and Insurance

- Solar vs Insurance: Do solar panels void homeowners insurance?

- Solar vs Insurance: Why do insurance companies not like net metering?

- Also Read: Why Insurance Wont Cover PRP Treatments: Understanding 4 Critical Reasons

- Solar vs insurance cost

- Solar vs Insurance: Do I need to tell my home insurance about solar panels?

- Solar vs Insurance: Can you become a millionaire selling life insurance?

- Solar vs insurance in Florida

- Solar vs Insurance in California

- Solar vs Insurance: 10 Benefits of Solar Panels and Home Insurance

- Conclusion: Solar vs Insurance

- Solar vs Insurance FAQs

- 1. Are solar panels automatically covered by homeowners insurance?

- 2. Does adding solar panels increase my insurance premiums?

- 3. What should I do if my solar panels are damaged in a storm?

- 4. Can I insure leased solar panels?

- 5. Are there specific insurance policies for commercial solar installations?

What Are Solar Panels?

Solar panels are devices that convert sunlight into electricity, providing a clean and renewable energy source for homes, businesses, and even large-scale power grids. With the growing focus on sustainability, solar energy has seen explosive growth, offering benefits like lower energy bills and reduced carbon footprints.

Why Solar Panels Need Insurance Coverage

Solar panels are durable, but they’re not indestructible. From severe weather events like hailstorms to accidental damage or theft, various risks can impact your solar investment. Insurance provides financial protection against these potential losses, ensuring you’re not left footing the bill for repairs or replacements.

Solar vs Insurance: Types of Insurance That Cover Solar Panels

1. Homeowners Insurance

Most standard homeowners insurance policies include some level of coverage for solar panels, particularly if they’re permanently attached to your home.

2. Specialized Solar Insurance

This type of policy is designed specifically for solar installations, offering comprehensive coverage for various risks.

3. Commercial Insurance for Businesses

Businesses with solar installations may need commercial property insurance to cover their panels.

Solar vs Insurance: How Homeowners Insurance Covers Solar Panels

1. Dwelling Coverage

Solar panels attached to your home are often covered under dwelling protection, which pays for repairs or replacements if they’re damaged by covered perils like storms or fire.

2. Personal Property Coverage

For portable solar systems, personal property coverage might apply, though limits can vary.

3. Common Exclusions and Limitations

Policies may exclude coverage for wear and tear, manufacturer defects, or damage caused by improper installation.

Also Read: Insurance Company Suing Me for Damages: 3 Shocking Types

Do You Need Separate Solar Insurance?

In some cases, specialized solar insurance is worth considering. It often provides broader protection, including coverage for energy production losses and maintenance issues, which standard homeowners insurance may not cover.

Solar vs Insurance: Factors That Affect Solar Insurance Premiums

- Installation Cost and Value: Higher-value systems typically lead to higher premiums.

- Location-Specific Risks: Living in areas prone to extreme weather can affect your rates.

- Insurance Provider Policies: Different insurers may have varying approaches to solar panel coverage.

Solar Panels and Liability Coverage

If your solar panels cause damage to a neighbor’s property or injure someone (e.g., a panel falling during a storm), liability coverage can help cover the associated costs.

Weather Risks: Solar Panels and Insurance Claims

Common Risks

- Hail damage.

- High winds or hurricanes.

- Heavy snowfall causing structural issues.

Filing Claims

To file a claim, document the damage thoroughly with photos and contact your insurance provider as soon as possible.

Roof vs Ground-Mounted Solar Panels and Insurance

1. Roof-Mounted Systems

These are often included in your dwelling coverage but can impact your roof’s structure, so proper installation is crucial.

2. Ground-Mounted Systems

These might require separate coverage as they’re not attached to the dwelling.

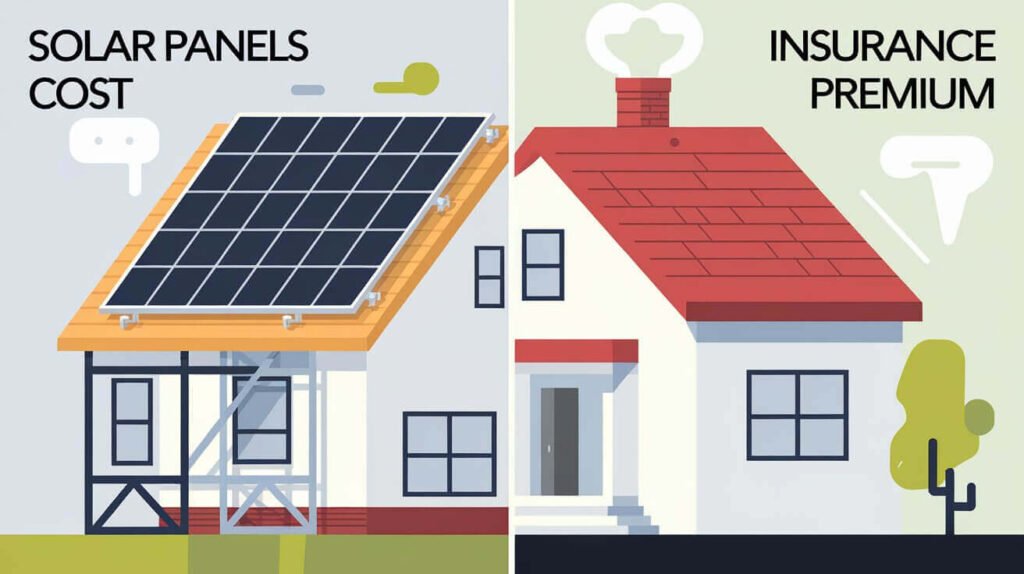

Cost Implications: Solar Panels vs Insurance Premiums

Adding solar panels might slightly increase your premiums because they raise your home’s overall value. However, the energy savings and potential tax incentives often outweigh these costs.

Do Solar Panels Increase Home Value?

Yes, solar panels can increase your home’s resale value, making it more attractive to buyers. However, this higher value may also mean higher insurance premiums to cover the added investment.

What If You Lease Solar Panels?

When leasing, the solar provider often retains ownership of the panels, which means they’re responsible for insurance. However, it’s still essential to confirm this with the leasing company.

Solar vs Insurance: Choosing the Right Insurance for Solar Panels

When evaluating insurance for your solar system:

- Ask about coverage limits and exclusions.

- Ensure your policy includes protection for weather-related risks.

- Consider specialized solar insurance for comprehensive protection.

Solar Incentives and Their Effect on Insurance

Government incentives like tax credits and rebates make solar installations more affordable, but they don’t directly impact insurance. However, they can offset the initial costs, making it easier to justify adding specialized coverage.

Future Trends: Solar Energy and Insurance

As renewable energy adoption grows, the insurance industry is evolving to meet new challenges. Expect to see more tailored policies and innovative solutions that align with the unique needs of solar panel owners.

Solar vs Insurance: Do solar panels void homeowners insurance?

- No, solar panels typically do not void homeowners insurance. However, there are a few considerations:

- Coverage Adjustments: Adding solar panels increases the value of your home. Some insurance policies might require you to adjust your coverage limits to reflect this.

- Roof Integrity: If solar panels are improperly installed and cause damage, that may not be covered unless specifically mentioned in the policy.

- Ownership vs. Leasing: Panels owned outright are usually covered, but leased systems may require separate insurance from the solar provider.

Solar vs Insurance: Why do insurance companies not like net metering?

- Net metering can make insurance companies cautious for the following reasons:

- Increased Risk of Claims: Roof-mounted solar systems and the associated electrical equipment may increase the risk of fire, weather damage, or liability claims.

- Power Grid Complexity: Solar energy systems interacting with the grid might complicate liability questions in the case of outages or grid damage.

- Economic Shift: As net metering incentivizes solar adoption, utilities may face declining revenues, indirectly impacting the financial stability of grid-reliant insurance scenarios.

Also Read: Why Insurance Wont Cover PRP Treatments: Understanding 4 Critical Reasons

Solar vs insurance cost

- Solar Panels:

- Upfront cost: $15,000–$30,000 (depending on size and location).

- Savings: Can reduce or eliminate electricity bills, typically saving $1,000–$2,000 annually.

- Insurance Cost Impact:

- Adding solar panels may slightly increase premiums by $100–$300 annually due to increased home value.

- Long-term benefits (reduced utility costs) often outweigh insurance cost increases.

Solar vs Insurance: Do I need to tell my home insurance about solar panels?

- Yes, you should inform your insurance company if you install solar panels. Here’s why:

- Policy Updates: Solar panels increase your home’s value, which may require higher coverage limits to ensure full replacement costs in case of a loss.

- Roof Liability: If the panels cause damage or create new risks (e.g., from storms), the insurer needs to account for these in your policy.

- Proof of Installation: Properly documenting the addition ensures clarity in claims.

Solar vs Insurance: Can you become a millionaire selling life insurance?

- Yes, but it depends on factors such as:

- High Sales Volume: Successful agents selling many policies can earn significant commissions.

- Target Market: Focusing on high-value clients or complex policies (e.g., whole life or large corporate insurance plans) can result in larger payouts.

- Persistence: Consistent effort over many years builds a substantial income.

- Residuals: Agents often earn renewals, adding passive income over time.

Solar vs insurance in Florida

- Florida-specific factors:

- Hurricane Risks: Solar panels in hurricane-prone areas must meet strict building codes, but their presence can still increase premiums slightly due to storm damage risks.

- Net Metering Policies: Florida offers favorable net metering laws, which encourage solar adoption, but the interplay with insurance policies can complicate coverage.

- State Incentives: Florida’s solar tax exemptions may offset costs, making solar a long-term financial benefit despite potential insurance increases.

Solar vs Insurance in California

- California-specific factors:

- Wildfire Risks: Many areas in California are high-risk zones, which could significantly raise premiums for homes with solar systems.

- Mandates: California mandates solar for new construction, making insurance companies increasingly familiar with these systems.

- Savings Potential: The combination of high electricity rates and generous state incentives makes solar cost-effective, even with potential insurance premium adjustments.

Solar vs Insurance: 10 Benefits of Solar Panels and Home Insurance

- Energy Savings: Solar reduces energy bills.

- Increased Home Value: Panels boost property value.

- Insurance Protection: Most homeowners insurance covers solar panels under dwelling protection.

- Disaster Resilience: Panels can be designed to withstand extreme weather, reducing claims.

- Net Metering Savings: You can earn credits for excess energy production.

- Long-Term Savings: Minor insurance increases are outweighed by long-term energy savings.

- Tax Incentives: Solar installations often qualify for federal and state tax credits.

- Environmental Impact: Reducing reliance on fossil fuels.

- Policy Customization: Insurers increasingly offer solar-specific riders for tailored coverage.

- Warranty Protections: Most solar panels come with long warranties, mitigating repair costs.

Conclusion: Solar vs Insurance

Investing in solar energy is a smart and sustainable choice, but it comes with responsibilities. Protecting your panels through the right insurance policy ensures your investment is safe from unexpected risks. Whether you’re a homeowner, a business owner, or considering leasing panels, understanding the interplay between solar and insurance is critical for peace of mind.

Solar vs Insurance FAQs

1. Are solar panels automatically covered by homeowners insurance?

Yes, in most cases, but it’s crucial to verify with your insurer to ensure adequate coverage.

2. Does adding solar panels increase my insurance premiums?

It might slightly, as they add to your property’s value, but the increase is generally minimal.

3. What should I do if my solar panels are damaged in a storm?

Document the damage, contact your insurer immediately, and file a claim according to their guidelines.

4. Can I insure leased solar panels?

Typically, the leasing company is responsible for insurance, but confirm this in your contract.

5. Are there specific insurance policies for commercial solar installations?

Yes, businesses can opt for commercial property insurance or specialized solar coverage tailored to their needs.