Why Insurance Wont Cover PRP Treatments: Understanding 4 Critical Reasons

Platelet-rich plasma (PRP) therapy has become a popular treatment option for a range of medical and aesthetic purposes but the question is Why Insurance Wont Cover PRP Treatments? From treating joint injuries and reducing inflammation to enhancing hair restoration and improving skin rejuvenation, PRP therapy offers significant benefits through a natural healing approach.

However, despite its growing popularity, many insurance companies choose not to cover PRP treatments. This leaves patients responsible for out-of-pocket costs, often making the procedure inaccessible to those who might benefit from it most.

This article will explore why insurance companies exclude PRP therapy from coverage, the financial impact on patients, and what options are available for those interested in this innovative treatment.

Table of Contents

- What is PRP Therapy, and How Does It Work?

- Why Insurance Wont Cover PRP: Understanding 4 Critical Reasons

- Also Read: Can a Doctor Look Up Without Insurance Card?

- The Cost of PRP Therapy Without Insurance Coverage

- Common Conditions Treated by PRP and Insurance Coverage Limitations

- Why Some Medical Treatments Are Covered, and PRP is Not

- Alternatives to PRP Therapy and Their Insurance Coverage

- Are There Insurance Policies That Cover PRP?

- How to Reduce PRP Therapy Costs Without Insurance

- Can PRP Therapy Help with Chronic Conditions not Covered by Insurance?

- How does Insurance Coverage for PRP Differ Across Providers?

- Can PRP Therapy be Combined with other Treatments Covered by Insurance?

- How Can Patients Advocate for PRP Coverage in Their Insurance Plan?

- Why PRP Injections Are Not Covered by Insurance

- Common Questions: Why Insurance Wont Cover PRP Treatments

- Who is Not Eligible for PRP Therapy?

- Why is PRP Not Recommended for Some People?

- Why Doesn’t Medicare Cover PRP?

- Is Platelet-Rich Plasma Therapy Covered by Insurance?

- Does Blue Cross Blue Shield Cover PRP Injections?

- Does United Healthcare Cover PRP Injections?

- Does Insurance Cover PRP Injections for Knees?

- When Will PRP Be Covered by Insurance?

- Does Aetna Cover PRP Injections?

- Why Insurance Does Not Cover Stem Cell Therapy

- What is the Cost of PRP Injections?

- Conclusion: Why PRP Therapy Remains Uninsured Despite Growing Demand

- Why Insurance Wont Cover PRP Treatments FAQs

- Why is PRP therapy considered experimental?

- Can I use my Health Savings Account (HSA) to pay for PRP therapy?

- Is there a way to get PRP therapy covered by insurance?

- Are there cheaper alternatives to PRP for joint pain?

- Will PRP therapy become more accessible with more research?

- Is PRP therapy effective for knee osteoarthritis?

- Why are PRP injections so expensive?

- Can I get PRP injections covered by insurance if I have a medical necessity?

- How many PRP injections will I need for my condition?

- Will PRP injections help with chronic tendon injuries?

What is PRP Therapy, and How Does It Work?

Platelet-rich plasma (PRP) therapy involves drawing a patient’s blood, separating the platelets through a centrifuge process, and reinjecting the concentrated plasma back into the targeted area.

Platelets contain growth factors that aid in tissue repair and reduce inflammation, making PRP a versatile treatment in both medical and cosmetic applications. It’s used to treat sports injuries, arthritis, tendon issues, hair loss, and skin aging, providing a more natural alternative to pharmaceuticals or surgical procedures.

Why Insurance Wont Cover PRP: Understanding 4 Critical Reasons

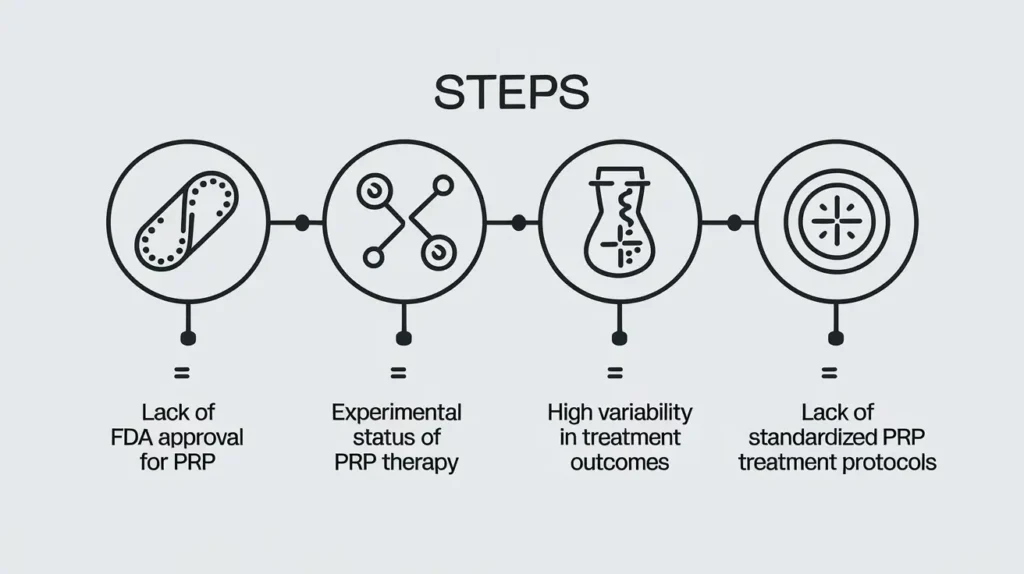

1. Lack of FDA Approval for PRP

One of the primary reasons insurance companies won’t cover PRP therapy is that the U.S. Food and Drug Administration (FDA) has not officially approved PRP for medical use. Insurance companies often rely on FDA approval as an indicator of a treatment’s efficacy and safety. Since PRP falls into a gray area without FDA endorsement, insurers are less inclined to include it in their coverage policies.

2. Experimental Status of PRP Therapy

Another factor is PRP’s designation as an experimental or investigational treatment. Although PRP has shown promising results, studies on its effectiveness are ongoing, and there’s limited conclusive evidence about its long-term benefits. Insurance companies generally avoid covering experimental treatments, as the risks and outcomes are not fully documented or guaranteed.

3. High Variability in Treatment Outcomes

PRP therapy results can vary widely among patients, depending on factors such as age, health condition, and the area of treatment. This variability makes it difficult for insurance companies to predict outcomes, adding uncertainty to their cost-benefit calculations. Without consistent results, insurers are reluctant to cover a procedure that might not work as expected for every patient.

4. Lack of Standardized PRP Treatment Protocols

Currently, there are no universally accepted protocols for administering PRP therapy. Differences in how the plasma is prepared, the number of treatments required, and the methods used by practitioners mean that PRP therapy lacks standardization. This makes it challenging for insurers to evaluate and approve the procedure.

Also Read: Can a Doctor Look Up Without Insurance Card?

The Cost of PRP Therapy Without Insurance Coverage

1. Out-of-Pocket Expenses for Patients

Patients who opt for PRP therapy must bear the full cost out-of-pocket, with each session costing between $500 and $2,500, depending on the treatment type and location. Multiple sessions may be necessary, particularly for chronic conditions or cosmetic purposes, significantly increasing the financial burden.

2. Cost Comparison with Traditional Treatments

Traditional treatments for conditions such as arthritis, hair loss, and joint injuries might be covered by insurance and can cost less over time. For example, insurance often covers corticosteroid injections, which are a less expensive, although temporary, solution for joint pain relief. In contrast, PRP therapy, though longer-lasting, presents an upfront financial challenge due to lack of coverage.

3. Accessibility Challenges for Some Patients

Because PRP treatment is often unaffordable without insurance assistance, some patients may not have access to this therapy even if it could potentially alleviate their symptoms. This creates a gap in healthcare access, where only those with financial means can pursue PRP treatment.

Common Conditions Treated by PRP and Insurance Coverage Limitations

1. PRP for Joint Pain and Arthritis

PRP therapy has shown effectiveness in treating joint pain and arthritis by promoting healing and reducing inflammation. Despite these benefits, insurance companies categorize PRP for joint issues as experimental. Instead, they often cover other treatments like corticosteroid injections or physical therapy, which may not offer the same long-term relief.

2. PRP for Hair Loss (Alopecia)

PRP therapy for hair restoration, particularly in treating androgenic alopecia, has gained attention for its success in stimulating hair growth. However, hair loss treatments are frequently excluded from insurance policies, even traditional medications like minoxidil or finasteride. PRP for hair loss is therefore not covered, leaving individuals who seek hair restoration to fund the treatment themselves.

3. PRP for Skin Rejuvenation and Aesthetic Purposes

Aesthetic uses of PRP, such as skin rejuvenation, are generally not covered by insurance, as they are classified as elective procedures. Treatments aimed at reducing wrinkles, improving skin tone, or treating acne scars fall into the cosmetic category, making them ineligible for coverage under most health insurance policies.

Why Some Medical Treatments Are Covered, and PRP is Not

1. Proven Clinical Efficacy

Insurance companies typically require substantial clinical evidence to demonstrate a treatment’s effectiveness before approving it for coverage. While PRP therapy shows promise, more large-scale studies are needed to establish its efficacy definitively. Until then, insurers are likely to consider it an unproven therapy.

2. FDA Approval Requirements

As previously mentioned, FDA approval significantly influences insurance coverage decisions. For PRP therapy to gain FDA endorsement, it would require extensive trials and conclusive results. The lack of FDA approval places PRP at a disadvantage compared to treatments like physical therapy or medication, which are widely recognized and covered.

3. Cost-Benefit Analysis

Insurance companies conduct cost-benefit analyses to determine the viability of covering specific treatments. Because PRP therapy can be expensive and lacks standardized results, insurers may not see it as a financially viable option to cover.

Alternatives to PRP Therapy and Their Insurance Coverage

1. Corticosteroid Injections

For joint pain, corticosteroid injections are often covered by insurance and can provide temporary relief. Though they do not promote long-term healing as PRP does, they are FDA-approved and have proven short-term effectiveness.

2. Physical Therapy

Physical therapy, which is typically covered by insurance, can be a viable option for joint pain or injury. While physical therapy doesn’t offer the regenerative benefits of PRP, it can help improve mobility, strength, and pain management.

3. Traditional Medications for Hair Loss

Medications like minoxidil and finasteride are commonly used for hair loss and may be partially covered under some insurance plans. While they do not produce the same regenerative effects as PRP, they are more accessible to patients due to their coverage status.

Are There Insurance Policies That Cover PRP?

1. High-Risk or Experimental Insurance Riders

Some insurance companies offer experimental or high-risk riders that may include PRP therapy. These riders are not common and generally come with higher premiums, but they offer an option for those seeking coverage for alternative treatments.

2. Medical Savings Accounts (MSAs)

If PRP therapy is not covered by traditional insurance, Medical Savings Accounts (MSAs) like Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) allow patients to set aside pre-tax dollars for medical expenses, including PRP therapy. Though this does not eliminate the cost, it can reduce the financial impact.

How to Reduce PRP Therapy Costs Without Insurance

Seek Out Clinics Offering Payment Plans

Many clinics recognize the high cost of PRP therapy and offer payment plans to make the treatment more accessible. Spreading out payments can help patients manage costs over time without needing upfront full payment.

Research Clinics with Competitive Pricing

Some clinics offer competitive pricing or discounts on PRP therapy. It may be worth researching various clinics or comparing prices to find a more affordable option.

Check for Clinical Trials

In some cases, clinical trials offer PRP therapy to participants at little to no cost in exchange for their involvement in research studies. Patients willing to participate in trials may be able to access PRP treatment without bearing the full expense.

Will PRP therapy become more accessible with more research?

Yes, as more clinical trials and studies validate the efficacy of PRP therapy, there is potential for it to gain wider acceptance and possibly be covered by insurance in the future. Research is ongoing, and positive results could lead to more insurance companies recognizing its value and adding it to their coverage plans.

Can PRP Therapy Help with Chronic Conditions not Covered by Insurance?

PRP therapy has shown potential in treating chronic conditions such as osteoarthritis, tendonitis, and muscle injuries, which often don’t respond well to traditional treatments. However, since insurance typically does not cover PRP for these conditions due to its experimental status, patients must explore other avenues like personal savings or payment plans to afford the treatment. Despite this, many patients report significant improvements in pain

How does Insurance Coverage for PRP Differ Across Providers?

Insurance coverage for PRP therapy can vary greatly depending on the provider and the type of policy. Some insurance companies may cover PRP therapy for specific medical conditions if it is considered medically necessary, while others may exclude it entirely.

It’s important for patients to review their policy details and contact their insurer to get clarity on whether PRP therapy is covered for their specific condition. In general, insurers are more likely to cover PRP for conditions like acute injuries where traditional treatments have failed, but not for cosmetic or elective procedures.

Is PRP therapy likely to be Included in Future Health Insurance Plans?

There is growing interest in regenerative medicine, including PRP therapy, as a viable alternative to traditional treatments. As more research supports its effectiveness, especially for conditions like arthritis and tendon injuries, it’s possible that PRP may be included in more insurance plans in the future.

However, this would require significant evidence demonstrating its long-term benefits, consistency in outcomes, and safety. If PRP continues to show positive results in studies, insurance companies may start to see it as a cost-effective treatment, leading to broader coverage.

Can PRP Therapy be Combined with other Treatments Covered by Insurance?

In some cases, patients combine PRP therapy with other treatments that are covered by insurance, such as physical therapy or corticosteroid injections. While PRP is often excluded, its effectiveness may be enhanced when used alongside more traditional treatments.

This combination can provide patients with a holistic approach to managing their condition. However, combining treatments means that patients may still have to pay for PRP out-of-pocket while utilizing their insurance for the other therapies.

How Can Patients Advocate for PRP Coverage in Their Insurance Plan?

While it may be challenging to secure insurance coverage for PRP therapy, patients can advocate for it by providing their insurance company with documentation from their doctor or specialist that outlines the medical necessity of the treatment. In some cases, doctors may write letters of medical necessity, or patients can request an appeal if their claim is denied. It’s essential to work with healthcare providers who are familiar with the process of requesting insurance coverage for treatments like PRP and to be persistent in seeking approval.

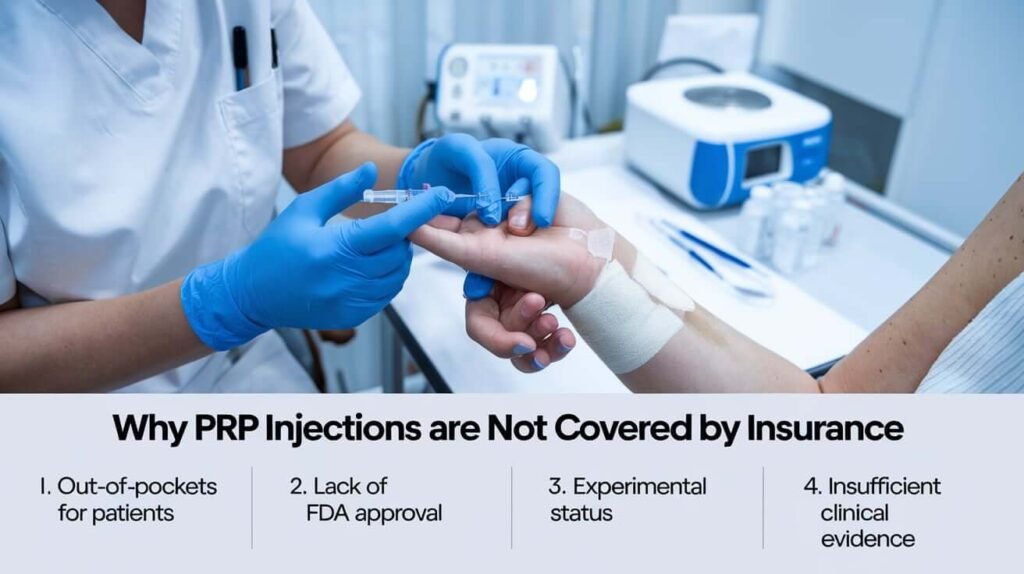

Why PRP Injections Are Not Covered by Insurance

Lack of FDA Approval

PRP injections are not fully approved by the FDA (Food and Drug Administration) for widespread use. This is a major reason insurance companies won’t cover the treatment. Since PRP therapy is classified as “experimental,” insurers view it as unproven compared to traditional treatments that have received full FDA approval.

Experimental Status

Because PRP therapy is still considered experimental, insurance companies hesitate to cover it. The lack of long-term clinical evidence means that PRP’s safety and effectiveness haven’t been conclusively proven in large-scale trials, making it a higher-risk option from the insurer’s perspective.

Insufficient Clinical Evidence

Though PRP injections show promise in treating conditions like joint pain, tendonitis, and osteoarthritis, there isn’t enough comprehensive clinical data to demonstrate its benefits consistently across all patients. Insurers rely on established data to justify covering medical treatments, and without it, they are reluctant to pay for PRP.

Out-of-Pocket Costs for Patients

As a result of these factors, patients are often required to cover the cost of PRP injections out-of-pocket. This can make the treatment less accessible, as it may be expensive, and insurance will not offset the costs unless PRP gains more robust approval and evidence over time.

Common Questions: Why Insurance Wont Cover PRP Treatments

Who is Not Eligible for PRP Therapy?

PRP therapy isn’t suitable for everyone. Patients with certain health conditions may not be eligible. These can include:

- Chronic conditions: People with autoimmune diseases or certain blood disorders may not be eligible, as their bodies may not respond to the platelet-rich plasma properly.

- Infection risk: PRP is extracted from the patient’s own blood, and those with blood infections or other conditions affecting the immune system may be excluded.

- Age restrictions: Although PRP therapy can be effective for people of various ages, younger patients or those with a history of blood-related conditions may need to discuss the potential risks with their healthcare provider.

Why is PRP Not Recommended for Some People?

While PRP has shown promise, it’s not recommended for everyone. The most common reasons include:

- Insufficient clinical evidence: Some areas of treatment (e.g., PRP for hair restoration or face rejuvenation) have not been thoroughly studied, and there may not be enough data to support their use.

- Possible side effects: Though rare, patients can experience irritation or infection at the injection site. There may also be an increase in inflammation.

- Limited effectiveness: Not all patients will see significant benefits from PRP therapy, particularly those with severe degeneration or long-term injuries.

Why Doesn’t Medicare Cover PRP?

Medicare typically does not cover PRP because it is categorized as an “experimental” or “investigational” treatment. This means that, according to Medicare’s guidelines, there’s insufficient scientific evidence to justify it as a medically necessary procedure. Furthermore, Medicare often only covers treatments that are FDA-approved for specific conditions, and PRP has not yet been fully validated in large-scale clinical trials for all of its uses.

Is PRP Therapy Covered by Insurance?

In general, most private insurance plans do not cover PRP injections, as it’s still considered an experimental procedure. However, some insurers may offer limited coverage if the therapy is deemed medically necessary for certain conditions, such as joint or tendon injuries, provided that other treatments have failed. It’s always important to check with your insurance provider beforehand.

Is Platelet-Rich Plasma Therapy Covered by Insurance?

The answer largely depends on your insurance company and the specific policy in place. While some health plans may reimburse a portion of the cost for PRP injections under special circumstances, it remains far from universal coverage. Most health insurance companies consider PRP to be outside the realm of traditional treatments and therefore don’t cover it.

Does Blue Cross Blue Shield Cover PRP Injections?

Blue Cross Blue Shield’s coverage of PRP injections can vary widely depending on the specific plan and location. Some regional BCBS branches may offer partial coverage for PRP injections for certain musculoskeletal issues, particularly when conventional treatments have been unsuccessful. However, it’s advisable to contact your local BCBS provider to determine your exact coverage details.

What Insurance Companies Cover PRP Therapy?

A few insurance companies may cover PRP therapy under specific conditions. These can include:

1. Cigna

2. United Healthcare

3. Aetna

4. Humana

However, the exact coverage depends on the medical necessity of the procedure and your insurer’s guidelines, so it’s crucial to verify this before undergoing treatment.

Does United Healthcare Cover PRP Injections?

United Healthcare does not typically cover PRP injections, as they classify it as an experimental treatment. However, in some cases, they may approve it if other more conventional treatments have failed and if the patient meets certain criteria. Again, checking directly with your insurer is essential for the most accurate and up-to-date information.

Does Insurance Cover PRP Injections for Knees?

PRP injections for knee pain, particularly for conditions like osteoarthritis, are one of the more commonly sought treatments. However, insurance coverage for knee PRP injections can vary. Some insurance companies may approve them if the knee pain is severe and if other treatments have been ineffective, but this approval is not guaranteed. Again, each insurer’s policy is different, and it’s important to confirm the details before seeking treatment.

When Will PRP Be Covered by Insurance?

PRP may be covered by insurance in the future as more research is conducted and more evidence is gathered about its efficacy. If large-scale studies continue to show positive results and the FDA approves PRP for additional uses, it’s possible that insurers will start offering coverage.

Is PRP Covered by Medicare in 2024?

As of 2024, Medicare still does not cover PRP therapy. Since it’s considered experimental and isn’t FDA-approved for standard use, Medicare adheres to its policy of only covering treatments that are considered medically necessary and widely recognized in the medical community.

Does Aetna Cover PRP Injections?

Aetna’s stance on PRP therapy is similar to many other insurers: they generally do not cover PRP injections unless they are considered medically necessary for specific conditions, and even then, approval can be difficult to obtain. Aetna may approve PRP therapy for certain musculoskeletal conditions if other treatments, like physical therapy or corticosteroid injections, have not been effective. However, you’ll need to check with Aetna directly to confirm your eligibility and coverage details.

Why Insurance Does Not Cover Stem Cell Therapy

While PRP therapy involves using a patient’s own blood, stem cell therapy is a different, more complex procedure. Stem cell therapy is often used for joint issues, spinal conditions, and even certain types of heart disease. However, like PRP, stem cell therapy faces significant challenges when it comes to insurance coverage.

The main reason for this is that stem cell therapy is still largely considered an experimental treatment, and many insurers refuse to cover it due to its high cost, the potential risks, and the lack of conclusive evidence regarding its efficacy. Stem cell therapy is also not FDA-approved for many conditions, meaning insurers typically classify it as an investigational procedure.

As more research emerges and regulatory agencies approve stem cell treatments for more specific conditions, insurance coverage may evolve. For now, patients must often pay out of pocket for stem cell therapy, just as they do for PRP injections.

What is the Cost of PRP Injections?

The cost of PRP injections can vary significantly depending on where you live, the provider you choose, and the area of the body being treated. On average, patients can expect to pay between $500 and $2,000 per injection. In some cases, more than one injection is required to achieve the desired results, which can drive up the overall cost.

Factors that affect the cost include:

- Location: Prices can vary widely based on geographic location. Larger cities or more affluent areas may charge more.

- Provider expertise: Doctors with a specialized skill set in PRP therapy or those working in a prestigious clinic may charge higher fees.

- Number of treatments: Some patients may need several PRP sessions for optimal results, which can increase the total cost.

While some people find PRP injections to be a worthwhile investment for their health and recovery, the out-of-pocket expense can be a barrier for many. Unfortunately, because insurance does not widely cover these treatments, most patients have to bear the entire cost themselves.

Conclusion: Why PRP Therapy Remains Uninsured Despite Growing Demand

Although PRP therapy is a promising and increasingly popular option for regenerative treatment, insurance coverage remains out of reach for most patients. Due to its experimental designation, lack of FDA approval, and variability in outcomes, insurers view PRP as a high-risk, low-coverage treatment. Until more research confirms PRP’s effectiveness across various conditions, insurance policies are unlikely to include it. For now, patients interested in PRP therapy must prepare to shoulder the costs themselves, though options like payment plans, MSAs, and clinical trials may offer some financial relief.

Why Insurance Wont Cover PRP Treatments FAQs

Why is PRP therapy considered experimental?

PRP therapy is considered experimental due to limited large-scale research and variability in patient outcomes. This lack of conclusive evidence prevents it from gaining FDA approval, impacting insurance coverage.

Can I use my Health Savings Account (HSA) to pay for PRP therapy?

Yes, in many cases, HSA and FSA funds can be used for PRP therapy, as they allow pre-tax dollars to be allocated for medical expenses.

Is there a way to get PRP therapy covered by insurance?

Some high-risk or experimental insurance riders may include PRP, but these are rare and often costly. Contact your insurer for specific details on coverage options.

Are there cheaper alternatives to PRP for joint pain?

Corticosteroid injections and physical therapy are more commonly covered by insurance and can be more affordable alternatives to PRP therapy for joint pain and inflammation.

Will PRP therapy become more accessible with more research?

Yes, as more clinical trials and studies validate the efficacy of PRP therapy, there is potential for it to gain wider acceptance and possibly be covered by insurance in the future. Research is ongoing, and positive results could lead to more insurance companies recognizing its value and adding it to their coverage plans.

Is PRP therapy effective for knee osteoarthritis?

Yes, PRP therapy has shown promise for treating knee osteoarthritis by helping to regenerate tissue and reduce inflammation. However, its effectiveness can vary from person to person, and it is typically used when other treatments have failed.

Why are PRP injections so expensive?

PRP injections can be costly due to the complex process of preparing the plasma and the expertise required for administering the treatment. The costs of medical equipment, laboratory testing, and provider consultation also contribute to the overall expense.

Can I get PRP injections covered by insurance if I have a medical necessity?

In some cases, insurance may cover PRP injections if they are deemed medically necessary and if other conventional treatments have failed. However, approval varies by insurer and plan, so it’s best to check with your provider before proceeding.

How many PRP injections will I need for my condition?

The number of PRP injections needed depends on the severity of your condition and how well you respond to the treatment. Some patients may require only one injection, while others may need a series of injections spaced over several weeks or months.

Will PRP injections help with chronic tendon injuries?

Yes, PRP injections are often used to treat chronic tendon injuries by stimulating healing in damaged tissue. Many patients experience significant improvement, especially when other treatments such as physical therapy or corticosteroid injections have not been effective.